Swiss Life Asset Managers: Purchasing in Paris

Swiss Life Asset Managers plans to acquire a premium office portfolio in the central business district of Paris. The seller is Terreïs.

A letter of intent was signed with Terreïs for a total of 28 core office properties worth €1.7 billion. Transfer of ownership is expected to take place by the second quarter of 2019.

According to the insurance group, the assets will be acquired from real estate funds managed by Swiss Life Asset Managers units in Switzerland, France, Germany and Luxembourg.

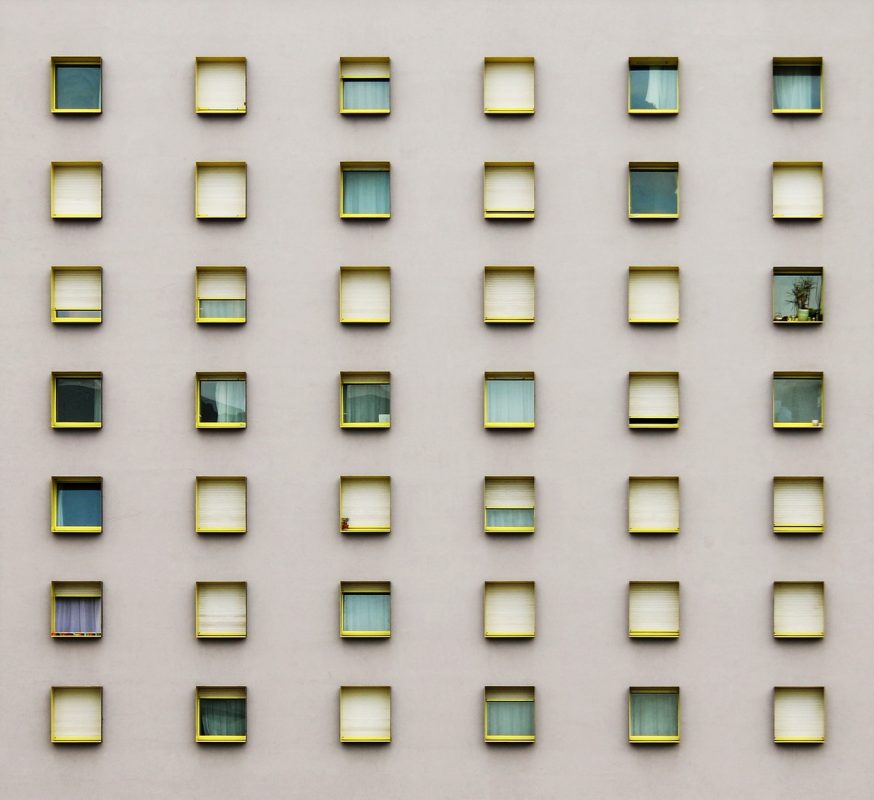

90 percent of the portfolio consists of high-quality office properties in the Central Business District (CBD) of Paris. Located in the heart of the French capital, the Haussmann-style architecture buildings are mainly located in the first, second, eighth, ninth and tenth districts - all areas where companies prefer to locate, from the luxury goods to the technology sector.

Frédéric Bôl, CEO France of Swiss Life Asset Managers, says: "We are proud to secure this exceptional portfolio in the Paris office segment, which is highly sought after by our clients. The availability of large transactions in Paris is limited and the assets we are looking to acquire are currently a rarity in the market." He added that the acquisition would give the acquiring funds "unique access to the Paris CBD office market" and "investment in high quality, rarely accessible buildings in prime locations but with declining rental potential that we can unlock through our asset management."

Paris is considered one of the most sought-after real estate markets in Europe, with low vacancy rates and rising rents in the office sector. Furthermore, new office properties are rare in the French capital. This is particularly true in the Central Business District, where supply has grown by only 6% over the past 40 years. This shortage of supply further increases the attractiveness of the Paris market. (bw)