Office market: Available space grew in Q2 according to CBRE

According to CBRE, office take-up fell significantly in the first half of 2023, while available office space increased, especially in Zurich.

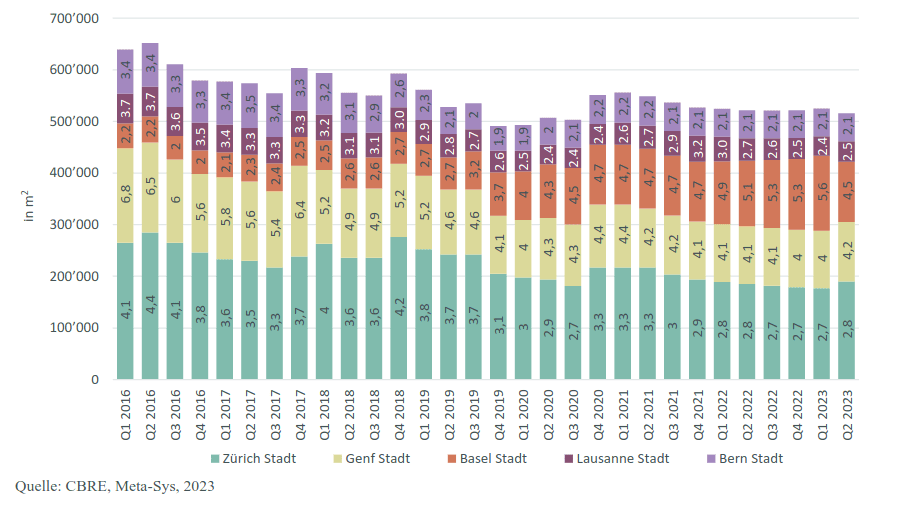

The real estate consultant CBRE speaks of a trend reversal in office availability in Switzerland. According to the latest figures from the second quarter, available office space has risen to 1.67 million sqm or 3.5% of the stock within three months. This is the second quarterly increase in a row. In Q4 2022, the figure had reached a multi-year low of 3.2%. "This is primarily due to additional office space supply in the suburbs of Zurich (airport region and Limmat Valley), where the availability rate rose from 15% to 16.6% within the first six months of the year," writes CBRE. The supply of office space on Zurich city land also increased to 190,000 sqm or 2.8%, which is 13,000 sqm more than in Q1 2023 (177,000 sqm or 2.7 %). This is the first increase since Q4 2020, with supply in Zurich's Central Business District in particular rising by 8,000 sqm to 51,000 sqm (2.6 %) within three months.

According to CBRE, the figures are in the context that some companies in the information and communication technology sector, which have accounted for a large proportion of demand in recent years, have reviewed or revised their expansion plans in Zurich. "In addition, the merger of the two largest Swiss banks, UBS and Credit Suisse, will also gradually have an impact on the Zurich office market," the real estate agency continues. "Even if these effects are not likely to be significant, they could create good opportunities for other market participants to find centrally located space in a still tense market environment with low construction activity and upward pressure on prime rents."

In Basel, it is noticeable that the increase in available office space has turned into a reduction in supply for the first time since 2016. "Some major letting successes in the CBD and Klybeck have led to a reduction in the availability rate from 5.6% to 4.5% (117,000 sqm) within one quarter." In the medium term, however, a significant increase in supply is expected.

Sales down significantly in the first half of the year

"Otherwise, the office space markets in the other Swiss cities of Geneva, Bern and Lausanne are stable and thus unimpressed by the slowdown in economic growth," it says. The Swiss office market has benefited from high take-up in recent years, and the good economic growth has even more than compensated for the effects of working from home. However, demand for office space has recently slowed due to the weakening economy, according to CBRE, and subletting activity has also increased. Office take-up in the first half of 2023 fell by 28% compared to the first half of 2022 to an average of 490,000 sqm per quarter. It is likely to remain at this lower level in the second half of 2023, which roughly corresponds to the long-term average, writes CBRE. (aw)