Viager Swiss: Real estate pension fund plans first issue

Gefiswiss, based in western Switzerland, aims to raise CHF 100 million by mid-March for the first real estate pension fund licensed in Switzerland. It promises investors access to the large market for Swiss owner-occupied homes.

The real estate asset management company Gefiswiss from Lausanne is planning a first closing for its Viager Swiss Scmpc product. "Pre-marketing in recent months has confirmed the interest of investors and the validity of the business model in the market for life annuities," the company writes in a press release. Capital of up to CHF 100 million is now to be raised by March 15. The fund is aimed at occupational pension schemes in Switzerland. The product - which the company claims is the first real estate annuity fund licensed in Switzerland - is based on a cooperation between Gefiswiss and Viager SA.

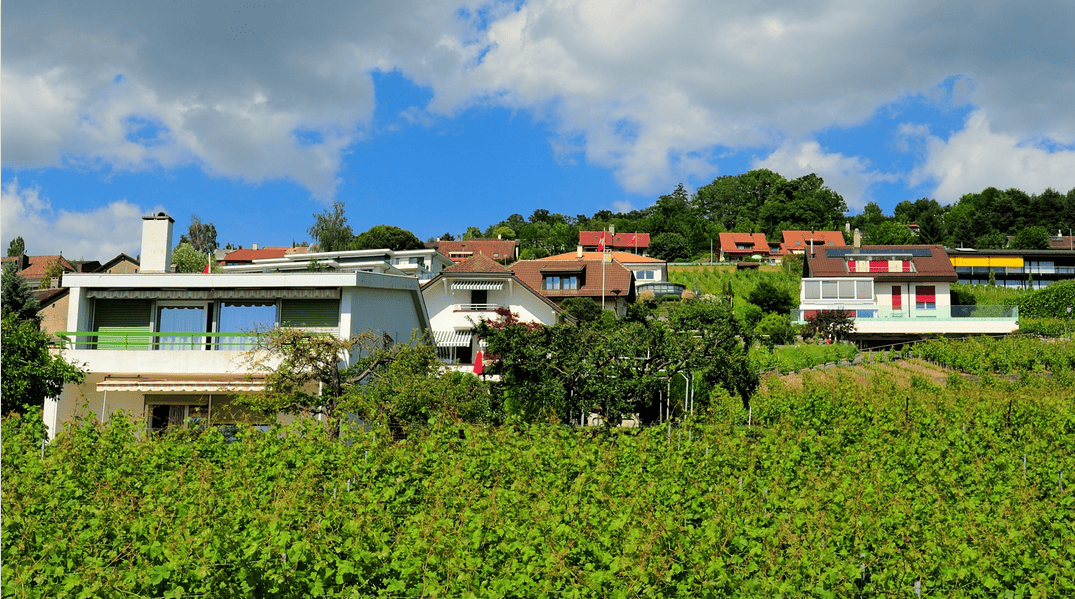

The fund advertises itself as offering diversified access to single-family homes and condominiums, which account for around 60% of the total real estate portfolio in Switzerland. The market segment has performed better than rental and commercial properties in the past. In addition, with the increasing life expectancy of the population, the declining purchasing power of older people and the need to remain in their own four walls is one of the greatest social challenges.

Viager Swiss Scmpc says it has a pipeline of 70 properties in the Lake Geneva region with a market value of over CHF 100 million, for which a real estate lease has been agreed. Gefiswiss is also negotiating a portfolio swap with a pension fund from French-speaking Switzerland. (aw)