Western Switzerland: Realstone AST buys in Geneva and Fribourg

The investment group uses the funds from a capital increase of just under CHF 50 million to purchase residential real estate in Fribourg and Geneva and secure additional properties.

According to the Realstone Investment Foundation, fourteen pension funds subscribed to the latest capital increase of the Realstone Residential Real Estate Switzerland (RIRS) investment group in mid-March, including four new pension funds. Realstone is using the funds raised, which amount to CHF 47.87 million, to acquire residential properties in western Switzerland. Three properties have already been transferred to the portfolio of the RIRS investment group. A further seven have been secured.

With the three acquisitions already completed, the investment group's total assets are approaching the CHF 400 million threshold. The total market value of the acquired properties amounts to CHF 27.61 million. Realstone reports a weighted return on equity of 3.35%.

100 apartments fresh in the portfolio

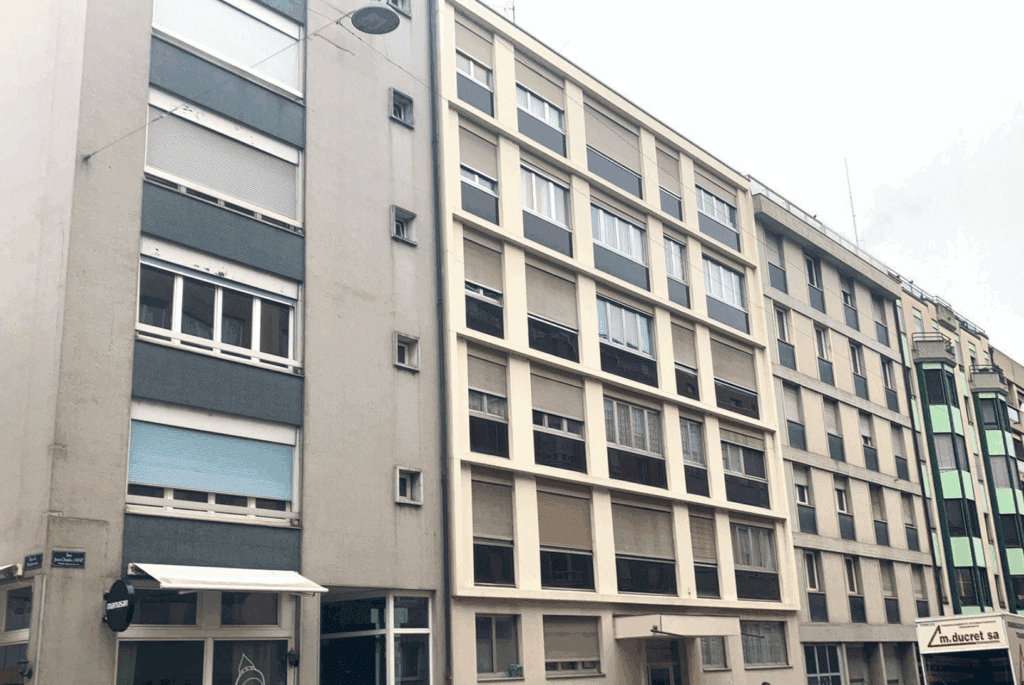

The first two properties are located in the immediate vicinity at Route Joseph-Chaley 25 and Route Monseigneur-Besson 5 in Fribourg and comprise 73 apartments. According to Realstone, the acquisition took place at the end of January, but ownership was transferred retroactively to January 1. The investment foundation states that the total market value of the two properties is CHF 17.65 million, which means that the return on equity is 3.38% with a rental income of CHF 869,075. The third property with a market value of CHF 9.96 million is located at Rue Jean-Charles Amat 16 in Geneva (GE), has 27 residential units and was added to the portfolio in March. According to the information provided, the rent roll amounts to CHF 373,320 and the return on equity to 3.30%. (aw)