Plazza AG wants to expand its management

Listed Plazza AG generated a pre-tax profit of CHF 24.6 million in the 2016 financial year. At the same time, it announces its intention to expand the management team by one position.

In the 2016 financial year, Plazza AG posted a pre-tax profit of CHF 24.6 million (previous year 2015: CHF 43.7 million), of which around CHF 15.0 million (CHF 32.5 million) was attributable to gains on the revaluation of properties. The decline in the past year is thus primarily due to the 17.5 million lower increase in property valuations compared with the previous year. Temporarily vacant commercial space also contributed to this result. In the residential sector, on the other hand, where Plazza has the main focus of its portfolio, the vacancy rate was reduced to 2.1 percent.

Further vacancy reduction planned for commercial properties

The vacancy rate of commercial properties was improved by 40 percent in 2016, some of which will already be reflected in income in 2017, Plazza said. The office vacancy rate fell to 44.9 percent at the end of the reporting year (previous year: 76.8 %). The re-letting of the remaining temporarily vacant office space is one of the focal points for the current year as well, the listed company writes.

Operating income before depreciation, amortization and revaluation decreased by 1.6 to 9.7 million. Real estate income decreased from 18.4 to 14.8 million due to temporary vacancies. At the same time, operating expenses were reduced from 8.0 to 5.5 million. Based on the operating performance, the Board of Directors of Plazza AG proposes to the General Meeting an unchanged distribution of CHF 3.00 per share (Class A registered shares) and CHF 0.60 per share (Class B registered shares).

In the year under review, Plazza invested 24.5 million in its development projects and existing properties. The company's major development projects have "promising prospects in the medium to long term," it adds. These projects are all running according to plan and the potential can probably be realized gradually from 2018 onwards. To reflect the importance of these projects, Plazza AG is now planning to create a management position for the project development segment.

Start of construction in Wallisellen, preparations for project in Crissier

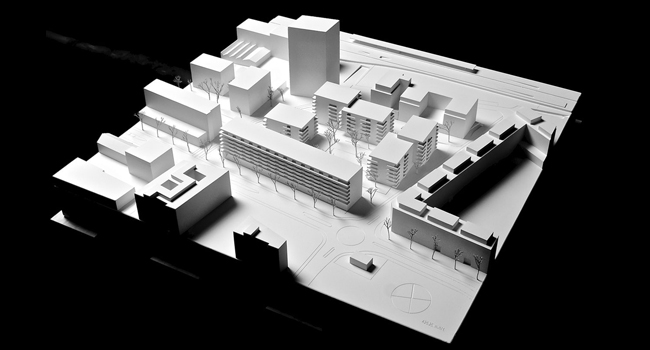

Construction work on the Plazza properties "Im Glattgarten" in Wallisellen with 218 apartments in the mid-price segment started at the beginning of 2016. Building construction work began in the second half of 2016. According to current planning, completion is expected in mid-2018. Marketing of the comparatively small proportion of commercial space on the first floors began towards the end of the reporting period. Initial letting of the apartments will start in the second half of 2017.

An approved design plan for the development site in Crissier near Lausanne has been available since February 2016. The preliminary project for this is currently being developed and the results are expected to be available in the second half of 2017. The results are expected to be available in the second half of 2017 and should provide the basis for trend-setting decisions regarding investment volume, staging and the possible involvement of co-investors. From today's perspective, Plazza is aiming to start construction in Crissier in 2020.

Increase in investments planned

For the current 2017 fiscal year, Plazza is forecasting a slight increase in operating income before depreciation and revaluation. At the same time, the vacancy rate at the commercial properties is to be further reduced despite persistently challenging market conditions. The successes from the revaluation of the properties should exceed the level of the reporting year "only in exceptional situations", according to expectations.

The residential segment remains a "reliable source of income for Plazza, even if a further reduction in the reference interest rate could cause rents in the residential segment to fall slightly in 2017," Plazza writes. For the development projects, the public limited company is planning investments in the order of 40 million in the current year.