Review of the 94th Swiss Real Estate Forum

The 94th edition of the "Swiss Real Estate Talks" was completely sold out days in advance. "We probably hit the nail on the head with the title," said presenter John Davidson. It was: "Pi times thumb? Real estate valuation in correction phases".

Whether he has the best job in the real estate industry is a question that each appraiser will answer individually. In any case, he was able to pursue his business away from the limelight for many years. But now that it's no longer all about the top, everyone is suddenly interested in his trade. All of a sudden, the evaluator is being pressed with the really big questions. Is what he is calculating the "truth"? Do his figures adequately "reflect" "reality"? Such formulations were frequently used recently at the latest talk in the "Swiss Real Estate Talks" series. The fact that it was a lively discussion was also due to the moderator John Davidson from Lucerne University of Applied Sciences and Arts. In a gripping opening statement, he made it clear that there is a suspected "disconnect" between valuation practices and the market. Although interest rates have risen by 200 basis points and although there has been a slump in transactions, the values on the books are still relatively stable. Hasn't the market known better for a long time? The prices of listed real estate investment vehicles have just had their worst year since the crisis in the 1990s.

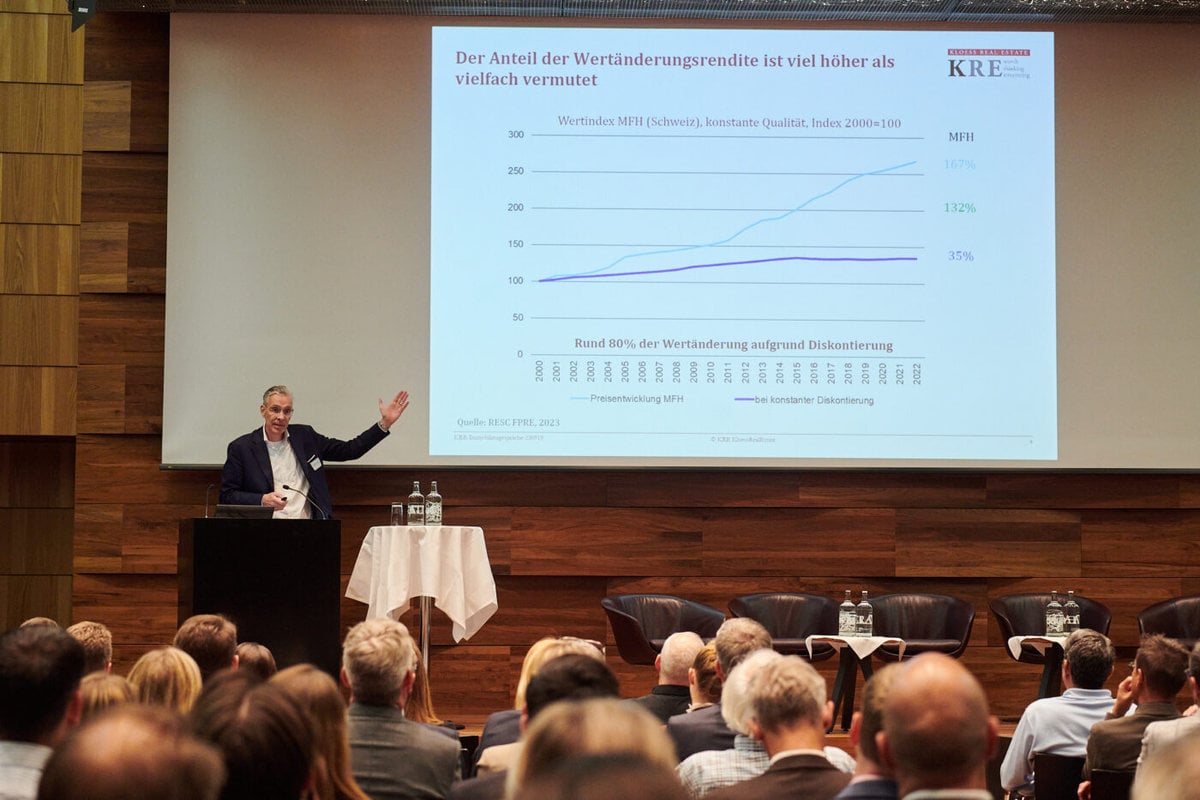

The first speaker Davidson invited to the podium was Stefan Kloess. The founder and managing director of Kloess Real Estate has valuation expertise himself and listed a number of fundamental concerns about the valuation system. He deliberately did so in a somewhat provocative manner, for example when he expressed surprise that the shelf life of a yoghurt in the fridge sometimes exceeds valuations. And he convincingly demonstrated that doubts about the accuracy of the evaluation methods are justified. According to Kloess, it is not uncommon for two results for the same property to differ by 20 percent. According to Kloess, it is problematic for the claim of accuracy when individual levers have huge effects. Of course, this primarily refers to the discount rate. As Kloess showed, citing a study by Fahrländer Partner, this can be responsible for up to 80 percent of the change in value. And the rise in the discount rate to an average of just 2 percent for very good residential properties seems moderate - at least in view of the severity of the interest rate turnaround that has now taken place.

Kloess expressed similar doubts about the factors that compensate for the effect of the higher discount rate in many calculations, such as the higher tenant expectations due to the reference interest rate adjustment. Kloess expressed the suspicion that this effect is having a more positive impact on values in the current phase than it would have if interest rates had fallen. However, the ability to pay of those who actually have to pay the higher rents on paper is limited.

It was not the most thankful task to take the stage as a valuer after this presentation. Daniel Macht, Head Valuation & Advisory Switzerland at JLL, thankfully did it anyway. He knew how to use the opportunity to raise understanding for the situation in which the valuer finds himself today. Data from JLL, which is also one of the largest transaction managers in this country, showed that the number of non-binding purchase offers in bidding processes has fallen by an impressive 50 percent in the last one and a half years, and even more in some segments; for example, 88 percent fewer players are now bidding for project developments. Only the liquidity of residential properties in A-locations is really solid. Macht's look at the structure of the bids was even more interesting. In order to assess the market, it is not only what comes out at the end - the purchase price - that is decisive. For the valuer, the question of what underlies this is even more exciting. This is important because the highest bid cannot be the market price if only because the most willing buyer would be lost in the event of an immediate resale - because he is now the seller. The market price is therefore in the range that also includes the second bid. And this shows that this area has expanded massively during the crisis. Not only have the bids become lower, they are now also less close together. Macht cited an extreme example that was actually carried out in this way: A transaction with two bids, one at 50 million, the other at 35. Valuers don't exactly have it easy in this market phase - when the market itself doesn't seem to know where it is.

Macht rejected the impression of blanket adjustments with examples of calculations that show how much the impact of the individual levers depends on the individual circumstances of the property. In the case of a residential property with high potential for rental growth, the higher discount rate could be almost completely offset. On the other hand, the higher discount rate has a much greater impact on a prime property, which reacts much more sensitively due to the extremely low yield - especially as there is rarely potential for rent increases in such cases. There is no interest in keeping values high. "As valuers, we don't make the market," Macht assured. It should not be forgotten that the market has a certain inertia. This also has to do with Switzerland and the dominant players there, who are very focused on security. These are circumstances that cannot be compared with those abroad.

Macht thus provided the cue for the next speaker. This was Sven Schaltegger, Head Multi-Manager Real Estate at Credit Suisse Asset Management, who has an overview of what is happening outside Switzerland. To put his remarks in a nutshell: Abroad, "the strongest and fastest rise in interest rates the world has ever seen" has had somewhat more pronounced consequences. Schaltegger's presentation thus led to the heart of a debate that has been raging ever since the Anglo-Saxon valuation system began to internationalize. This is because the greater dynamism abroad is not only due to the fact that both interest rate rises and inflation have been considerably more pronounced there. It is also linked to the fact that valuations in the USA, for example, react more quickly to macroeconomic changes.

There are two quite contrasting philosophies as to what valuations should achieve. The Anglo-Saxon one - Schaltegger called it "mark to market" - is concerned with reflecting the price at which a property can be sold. And the other - "mark to model" - is concerned with reflecting the long-term value. This is the understanding of valuation that predominates in Germany and Switzerland in particular. Evidence from tangible transactions is essential for both approaches - something that is in short supply in the current market situation. However, while the "mark to market" method also relies on mere sentiment, which leads to more volatile results, the "mark to model" avoids sharp fluctuations in value, which also invites nasty comments in times of disconnect with market sentiment.

Whatever divergence and potential conflicts may have unfolded up to that point, the closing speaker managed something of a synthesis, which even sounded conciliatory in places. Stefan Lüthi, Head of Asset Management at Zürcher Kantonalbank, gave good reasons why it would be inappropriate to bash valuers. "As institutional investors, we have to publish the fair value, that's what the regulator wanted," he says. He calls the calculated fair value a "valuable snapshot". He clearly identifies the challenges of the DCF method - it is based on past data, and far more than half of the result depends on assumptions about the second half of the modeled period - above all on the expected cash flows. And yet: "We have to expect it, and we can". However, Lüthi also demands that all those value drivers that will play a foreseeable role are also taken into account in the discount rate. For example, the topic of ESG should be priced in, and something like "impact investing" - a strategy that is willing to go beyond the fulfillment of regulatory requirements and - at the very least - aims to increase social benefits - could also be priced in. Could "affordable housing" become a measurable value driver in the future?" asked Lüthi. And he had another exciting idea up his sleeve: regulatory risks should also be mapped in calculation games. This could mean that cities with governments that are willing to regulate could receive a discounting penalty for apartments, meaning that the surrounding area could gain advantages in the valuation for the first time.

However, there was another thought at the heart of Lüthi's considerations: even if fair value fulfills its purpose, it is not the last word for the investor. They should be guided by another parameter, the "investment value". A striking example illustrates what is meant: if there is a prospect of consolidation for a particular investor and thus the chance of realizing a new construction project, a property may be worth more to him than to a buyer who "only" wants to acquire the existing property. The value of a property also depends on the specific know-how of the investor - not everyone can do hotels or brown field - and also on the product strategy and capital structure. "If my investment value is less than the market value: then I should sell, if it is greater, then buy". In other words, for fundamental reasons, there is no objective truth in fair value. If one investor offers half as much as another, then it would be wrong to say that he is wrong.

To take this evening's fascinating insights further, one could ask: Is the concept of investor value perhaps more fundamental than that of market value? Is the idea that there is an objective value in real estate - like protein in yogurt - ultimately absurd? Perhaps you always have to think about the person for whom the property is supposed to have a value? And doesn't the view of the practice of valuers become more conciliatory if one remembers that the focus on the point in time is inevitably associated with a very limited claim? - Kloess made this point several times. In any case, anyone who enjoys fundamental considerations got their money's worth that evening. And he could say: It's a shame that such discussions only seem to take place during downturns. (aw)

The next real estate talk will take place on November 21, 2023 in Zurich.