Warteck Invest: Result before revaluation increased

Unlike in the previous year, Warteck Invest devalued in the first six-month period. This had a negative impact on consolidated profit. Before revaluation, however, the company can make gains

The target rental income of Warteck Invest rose by CHF 18.9% to CHF 22.4 million in the first half of the year due to the acquisitions in the previous year. At CHF 19.0 million, rental income exceeded the previous year's result by CHF 16.0%. In operating terms, i.e. excluding the revaluation result, consolidated profit rose by CHF 19.7% to CHF 11.2 million. However, the revaluation led to a devaluation of the portfolio byTP3T 0.41. As there had been a revaluation (of CHF 0.3%) in the same period of the previous year, the consolidated profit of CHF 8.0 million was now CHF 24.3% below the previous year's figure.

As a result of the last capital increase, the loan to value of the real estate portfolio fell from 52.3 to 44.6%. At 1.8%, the average capital-weighted interest rate paid in the first half of the year was on a par with the figure for 2023 as a whole. No transactions took place in the first half of 2024. Instead, CHF 4.9 million was invested in repairs to existing properties and refurbishment and development projects. As a result, the value of the real estate portfolio increased by 0.1% despite the valuation adjustment. It stands at a good CHF 1 billion.

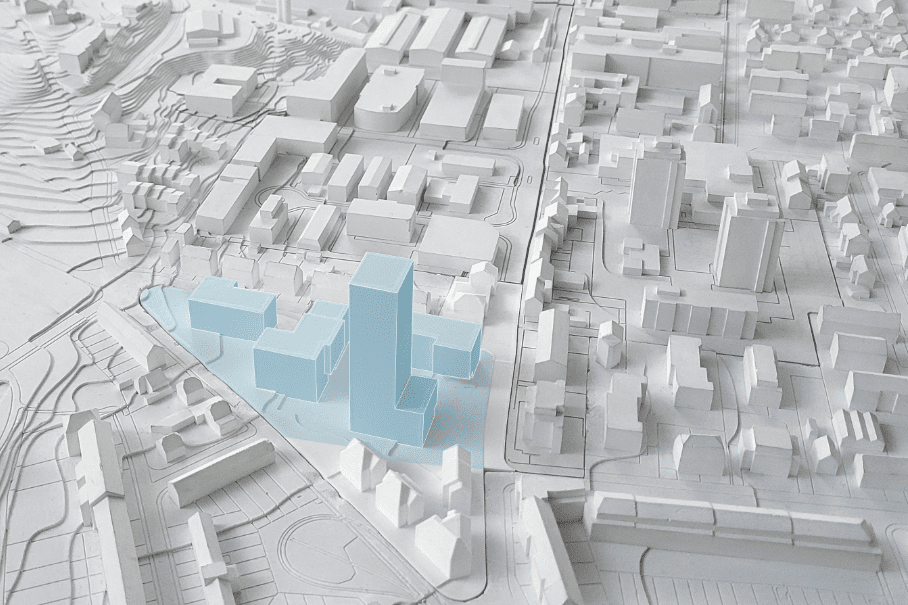

Progress with the site developments

Warteck's projects include, in particular, three site developments in Allschwil (BL), Muttenz (BL) and Buchs (AG). In Allschwil, where a complete renovation of the development and redensification of the site is planned, the neighborhood plan is to be submitted to the residents' council for approval this year. In Muttenz, where a residential and commercial building with a gross floor area of 12,500 sqm can be built on the Warteck Invest plot, planning is at the preliminary project stage. In Buchs, an existing office building is to be replaced by a new residential development. The planning application is to be submitted this year.

At -2.7%, the total return on the share was below the benchmark in the first half of the year (+3.0% according to the SXI Real Estate All Shares Index). (aw)