Commercial space market remains under pressure

Rents for office and retail space in the Swiss real estate markets suffered from a supply overhang in the second quarter of 2016. According to the latest "Country Snapshot Switzerland" by Cushman & Wakefield and alliance partner SPG Intercity, the economy is not expected to recover until 2017 at the earliest, and until then landlords will be forced to reduce rents or offer incentives.

According to surveys by SPG Intercity, the supply of vacant office space increased across the market in the second quarter. One exception is Zurich's Central Business District (CBD), where there are signs of a slight easing. Financial firms in particular, but also other sectors, continued to consolidate. Researchers at SPG Intercity expect space consolidations to continue. "As a result, rents remain under pressure. Landlords are trying to absorb this primarily through further incentives such as rent-free periods and cost-sharing in tenant improvements," the experts write in the study. Letting is only likely to pick up visibly once companies' confidence in an imminent upturn grows. Such an upturn is not in sight until 2017 at the earliest.

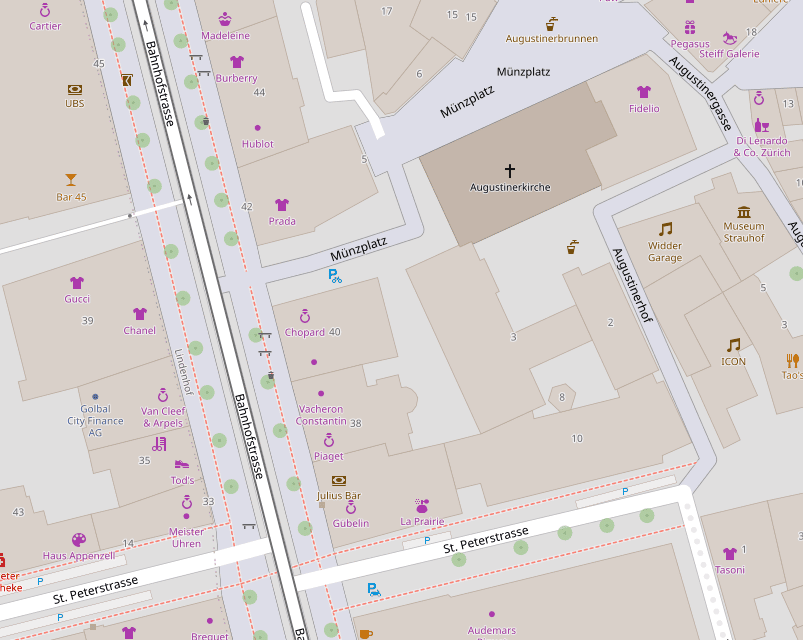

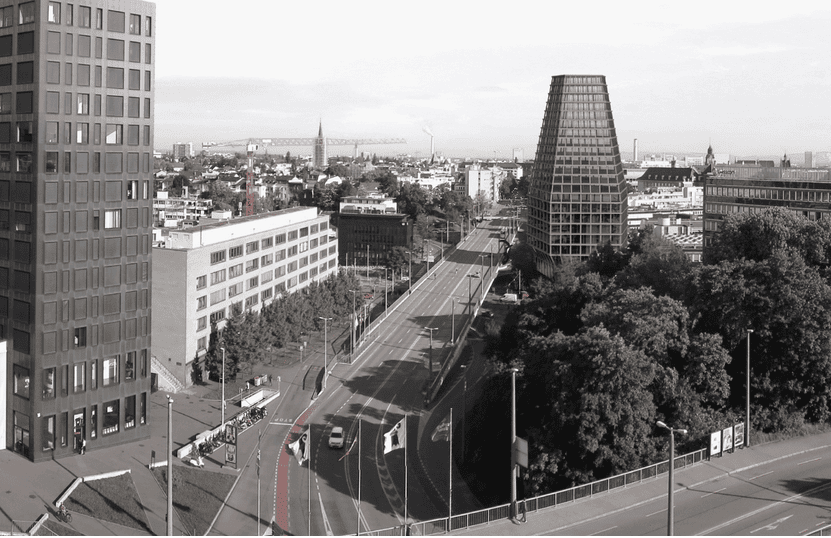

Mid-year rents for prime office space are unchanged from a year ago at CHF 750, CHF 800 and CHF 350 per sqm/year for Zurich, Geneva and Basel, respectively. Net initial yields on office properties for the three cities are 3.70, 4.00 and 4.40 percent, "which is still a considerable spread compared to long-term interest rates," according to SPG Intercity.

In the retail space market, the number of vacant sales premises is up 4.7 percent year-on-year at mid-year. Rents away from prime locations are softening across the board under pressure from market supply and stronger tenant positions, according to market observers. The city of Basel on the Rhine has been hardest hit by the drop in prices due to its proximity to the German border, with rents here falling 14.8 percent year-on-year, even in preferred locations. Yields are at or near long-term lows of 3.20 percent for Zurich, 4.25 percent for Geneva and 4.35 percent for Basel, according to SPG Intercity's "Country Snapshot Switzerland." (ah)