Review 76th Swiss Real Estate Talk: "Buy and hold was yesterday!"

The 76th Swiss Real Estate Meeting, to which the editorial team and Galledia Fachmedien AG invited guests to the Metropol in Zurich in May, was a very special occasion: the 25th anniversary of the trade magazine IMMOBILIEN Business.

Making the right investment decisions is not so easy, especially in an environment dominated by negative interest rates. In view of the lack of investment alternatives, real estate remains attractive and, while property prices are likely to remain high, yields are likely to remain low. Particularly as vacancies are increasingly on the horizon in Swiss conurbations, especially in the multi-family housing sector. On the occasion of the 25th anniversary of the Swiss trade magazine IMMOBILIEN Business, moderator John Davidson of the Lucerne University of Applied Sciences and Arts (HSLU) began by outlining the current major trends and the resulting questions for the players in the Swiss real estate market. Then, at the 76th Swiss Real Estate Talks, four experts spoke on the topic "Buy and hold was yesterday!" and discussed with each other.

"The data is appealing, but not power-packed".

First, Dr. Stefan Fahrländer of FPRE outlined the factors influencing the Swiss real estate market: The economic data "are appealing, but not powerful"; what is missing is somewhat higher inflation, but no one knows where this will come from. So we remain in the familiar situation of low interest rates - and hope. As we all know, hope dies last. Fahrländer sees risks above all in the rising vacancy rates, not exactly in the top 10 locations, but in the periphery, not least because of the current decline in immigration figures. In addition, according to a survey by the Swiss Homeowners Association (HEV Schweiz), there is an unhealthy discrepancy between supply and demand for building land. Nevertheless, residential construction activity remains high. Fahrländer expects prices to continue to rise in the multi-family housing sector, but at the same time rents to fall. He also pointed out that around three quarters of the changes in the value of these properties are attributable to the discount rate.

"'Buy and Hold' is still possible today"

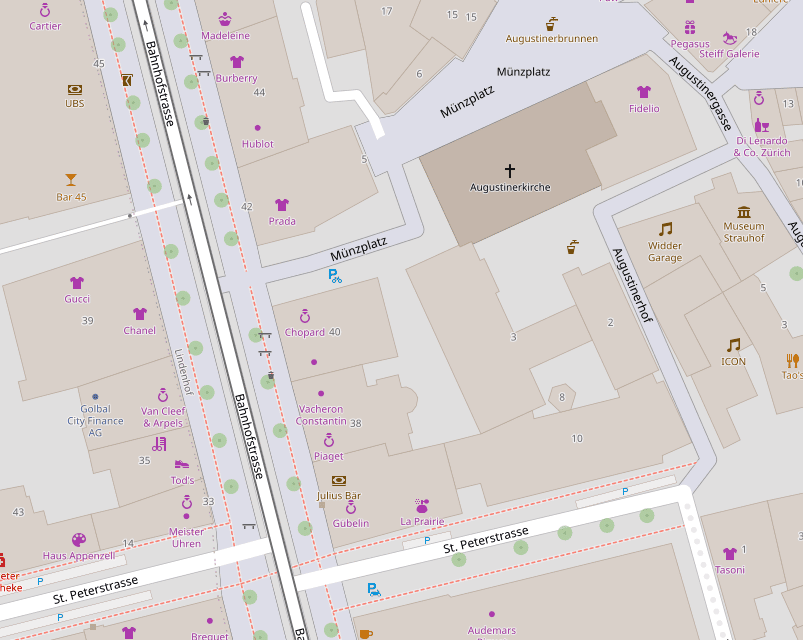

Frédéric Königsegg of Helvetica Property Investors AG, who then took a look at the situation on the commercial property markets (office, retail, logistics), believes that B locations will remain attractive. In addition to the large metropolises, cities such as Baden, Olten and Thun in particular have their charm. The real estate funds set up by Helvetica, with a current volume of around 430 million francs in property value (21 properties; average vacancy rate 5.8 %), showed that attractive returns could be achieved in such locations. Königsegg cited two properties in Baden and Goldach as examples, with gross initial yields of 6.0 and 6.28 percent respectively. "However, the 'buy and hold' strategy is still possible in prime locations today." Especially also if you complement it with active "hands-on" asset management, Königsegg said. The general diversification of investments and a focus on multi-tenant properties are other important characteristics of HSC funds, he said. Helvetica's special niche is commercial real estate with a purchase value of between ten and 30 million Swiss francs - here it is not in competition with the very large investment firms, but also not with family offices or wealthy private investors.

New principle "location, location, quality

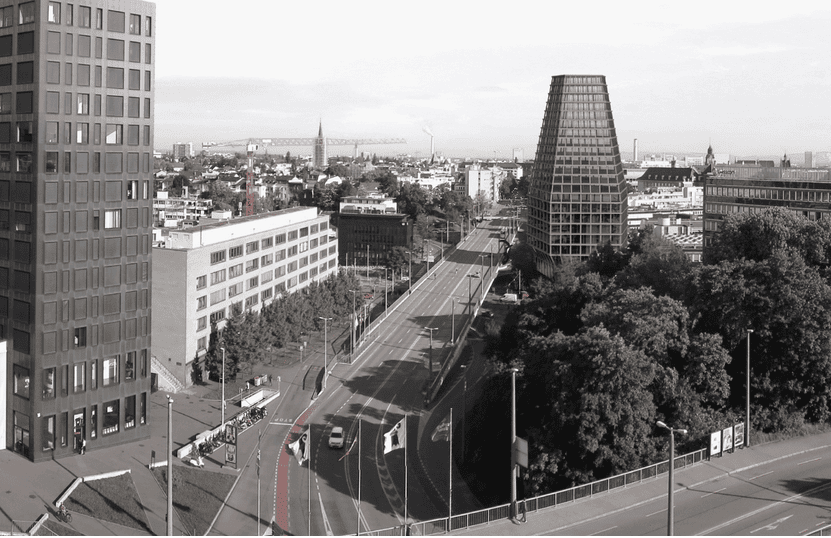

Martin Munz, who is responsible for the Development & Construction Investment Real Estate division at Credit Suisse AM, began by highlighting the situation on the office real estate market at the most recent Real Estate Talk and sees a "clear tenant market" here due to the oversupply of space, such as in Zurich North. The development opportunities in the conurbations are "largely exhausted". On the residential property side, the signs are pointing to repositioning, renewal and densification of existing properties, especially in the centres and locations close to the centres. For example, CS has "intensively combed through" its real estate portfolio and is currently developing a volume of two billion francs with regard to repositioning existing buildings and developing new ones. For Munz, looking at both macro and micro locations is of great importance, and optimal public transport connections are a general "must". "The value of the product is becoming more and more crucial," Munz said. Nowadays, the new principles of "location, location, quality" and "location, location, floor plan" apply more and more. Real estate owners have to act future-oriented and anticipate needs and demand. In addition to the residential sector, this also applies to office properties, where employee satisfaction has recently become much more important for the companies renting.

Today's tenants are more transient

Arno Kneubühler of Procimmo SA outlined current demand trends based on his company's six real estate funds in German-speaking and French-speaking Switzerland. By concentrating on niche sectors such as logistics and commercial space for SMEs, the company is pursuing a rather "defensive strategy" and is aiming for gross returns of seven percent here, "also because a lot of capex has to be taken into account here". Procimmo's focus is therefore on B locations with comparatively low rents, according to Kneubühler. Here, Procimmo would rent out or turn over about 100,000 square meters every year. One reason for this is the constant change. Today, tenants no longer enter into long-term contracts, the demand for space is constantly changing and many a company goes bankrupt. It is necessary to be able to react quickly and efficiently to all these factors. Kneubühler cited the example of Champs du Port in Onnens, where the Philip Morris International tobacco group will finally vacate its site this year. Procimmo acquired the 75,000 square meters of logistics space in a sale-and-lease-back transaction for 49.7 million Swiss francs. The rental income at the time of purchase amounted to five million francs per year. The new tenant on a quarter of the space (18,000 sqm) is the French sporting goods chain Decathlon, which supplies its Swiss stores from the site near Yverdon.

Claims, risks and reality

The panel discussion that followed dealt with the topics of housing, centrality and city logistics in particular, as well as the influence of politics on the real estate markets and the investors' search for yield in general. The panelists at the real estate discussion agreed that today is a very dynamic time and that one must be able to react quickly to surprising changes on the part of the federal government, cantonal regulations or even the global economy. In general, however, the Swiss market poses a problem due to its manageable size, they said. Frédéric Königsegg put it this way: "It is a small market with few players. It will be fine as long as the market goes up." Martin Munz also warned against regional votes such as the Basel housing initiative and the threat of "Geneva conditions" there. For Arno Kneubühler, politics is called upon to create good framework conditions for the real estate industry, "so that things progress positively". And finally, in the discussion about the demands and reality of real estate investors, Stefan Fahrländer argued that citizens and tenants should not be forgotten in the pursuit of returns and in view of current developments, for example in Basel or Berlin.