Office market: lowest turnover since the financial crisis

According to CBRE, office space remains scarce in Zurich, but falling demand and the home office effect are having an impact in peripheral markets.

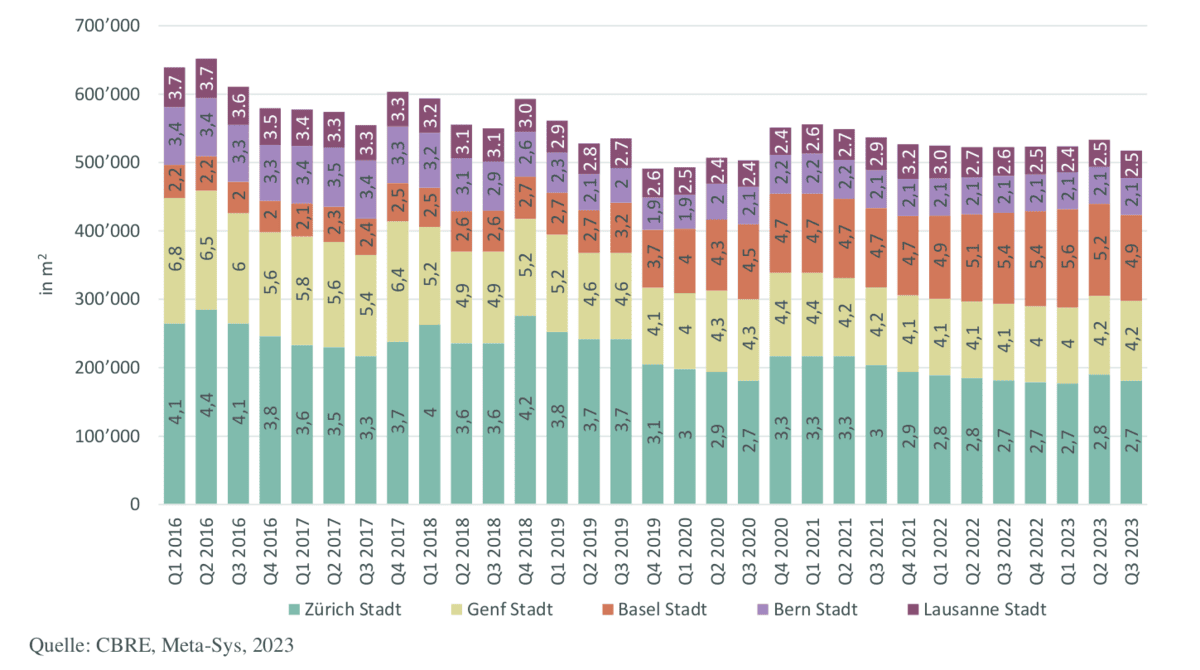

According to the latest Q3 figures from CBRE Switzerland, available office space increased for the third quarter in a row to 1.82 million sqm or 3.8% of the stock. In Q4 2022, they had reached a multi-year low of 3.2%. According to CBRE, the reason for the increase is a growing supply of office space in the peripheral office markets outside the five largest office markets of Zurich, Geneva, Basel, Bern and Lausanne and their suburbs.

The suburbs of Zurich, Geneva and Basel have also recorded an increase. At 273,000 sqm or 13.3%, there are more offices available for rent in the Zurich airport region and the Limmat Valley in absolute terms than ever before. According to CBRE, the increase in office supply can mainly be attributed to a decline in additional demand, but not to construction activity. In the first three quarters of 2023, take-up of space across Switzerland fell by 40% year-on-year to an average of 367,000 sqm per quarter, the lowest level since the financial crisis (2009).

Working from home is only now making itself felt

The office market had benefited from high take-up in recent years, with good economic growth even more than offsetting the effects of working from home. However, demand for office space has recently slowed due to the weakening economy. In addition, many companies have needed time to adapt to the new working conditions after coronavirus. According to CBRE, the reduced demand for space due to working from home is only now beginning to manifest itself in vacancies. However, this does not apply to central locations. "Criteria such as good accessibility, sustainability and a good basic fit-out on the part of the landlord have become even more important for tenants," writes CBRE.

Zurich: Offer falls to 2.7%

Accordingly, office supply on Zurich city land fell slightly in Q3 2023 to 181,000 sqm or 2.7%. In Zurich's CBD (Central Business District) in particular, office availability was reduced by 13,000 sqm to 38,000 sqm compared to the previous quarter. This corresponds to a low availability rate of just 2.0%. "Despite ongoing structural adjustments in the financial sector, the market structure in Zurich will remain stable in the coming years, even if some medium-term space requirements have already been announced," the report states.

The supply of office space in the city of Basel has also continued to recover. Some major letting successes in the north of Basel, such as in the Werkarena, have led to the availability rate falling from 5.6% to 4.9% (125,000 sqm) within two quarters. However, CBRE believes that supply will increase again significantly in the medium term. The office space markets in the other Swiss cities of Geneva, Bern and Lausanne were "relatively stable". (aw)