Office market: Vacancy rates continue to rise according to JLL

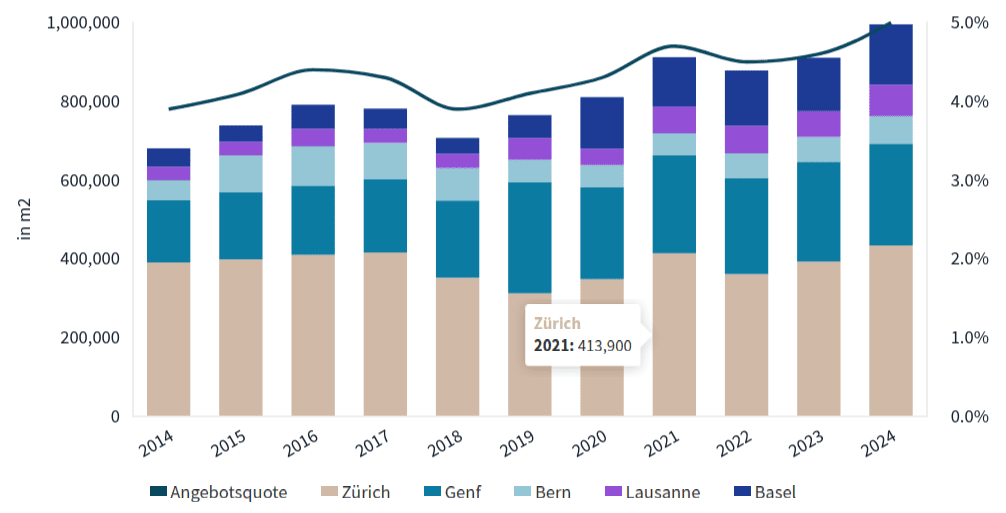

According to the consultancy, almost one million square meters of office space are now vacant. In an international comparison and in relation to new construction in recent years, the increase is still moderate.

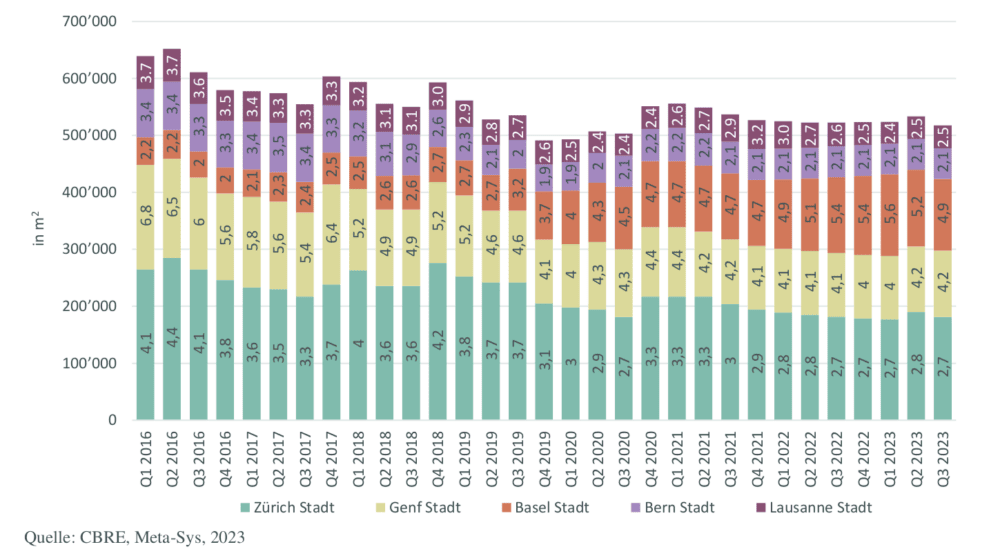

According to the new office market study by JLL, supply in the five largest office markets in Switzerland increased by 9 % compared to the previous year. It amounted to 995,500 sqm at the end of the year. Since the end of 2019 - when the issue of working from home was not yet virulent - the average supply ratio in the top 5 has risen from 4.1 to 5.0 %. In an international comparison, however, the increase does not look dramatic: In the 24 most important European markets, the average vacancy rate increased much more sharply in the same period - from 5.2 to 8.5 %.

"We have bottomed out"

Even in relation to the 1.16 million sqm of new office space created since 2020, the increase in supply of 231,000 sqm measured in the same period is moderate. Construction activity peaked in 2020 with around 343,000 sqm of newly created office space and then fell continuously to 57,000 sqm in 2024. "This means that we have bottomed out and volumes will rise again every year from 2025 to 2027," says JLL researcher Daniel Stocker.

Strongest growth in Geneva

The differences between the various market regions are nevertheless considerable. Measured against the current stock, Geneva recorded the highest growth between 2019 and 2024 (Ø 2.0 % of the stock), with the expansion in floor space set to be even stronger until 2027 (Ø 2.3 % of the stock). In Bern, construction activity is increasing significantly compared to the past, but future growth will only be slightly above the Swiss average at an average of 1.1 % per year. Conversely, an average of 71 % and 58 % less new office space will be created in Zurich and Basel by 2027 - compared with the period from 2019 to 2024. By 2027, the office stock will grow by an average of 1.0 % per year, which is 26 % less than in the recent past.

JLL describes the demand for space as "intact overall". However, finding tenants for vacant space in older buildings without a train station within walking distance remains a challenge. On the other hand, the market is absorbing modern, flexibly usable and ideally sustainability-compliant office space with good connections comparatively quickly. This is reflected not least in the limited supply in these locations.

Almost 10 % vacancies in Basel city center

In Zurich's Kreis 1 district, 3.0 % of office space is available, in Lausanne's CBD 1.5 % and in Bern's city center only 0.4 %. Available office space is also scarce in the cities of Lucerne (1.3 %), Zug (1.7 %), Fribourg (2.0 %) and Lugano (2.1 %). The vacancy rate in Geneva's CBD is higher at 3.9 %. In the city center of Basel, as much as 9.2 % of space is vacant. (aw)