Risk and asset management supports capital

Further increases in discount rates will put pressure on real estate values in 2023. Strong asset management and the use of structural trends increase resilience in a core real estate portfolio.

Income increases as inflation protection

Real estate is a good partial hedge against inflation, as current income can be actively influenced by the asset manager. Capital values are partly supported in the current interest rate environment by expanding rental income, increasing efficiency and reducing costs.

Fewer projects are currently being initiated due to the disrupted construction financing. The limited supply following the global economic recovery will have a positive impact on returns in the medium term.

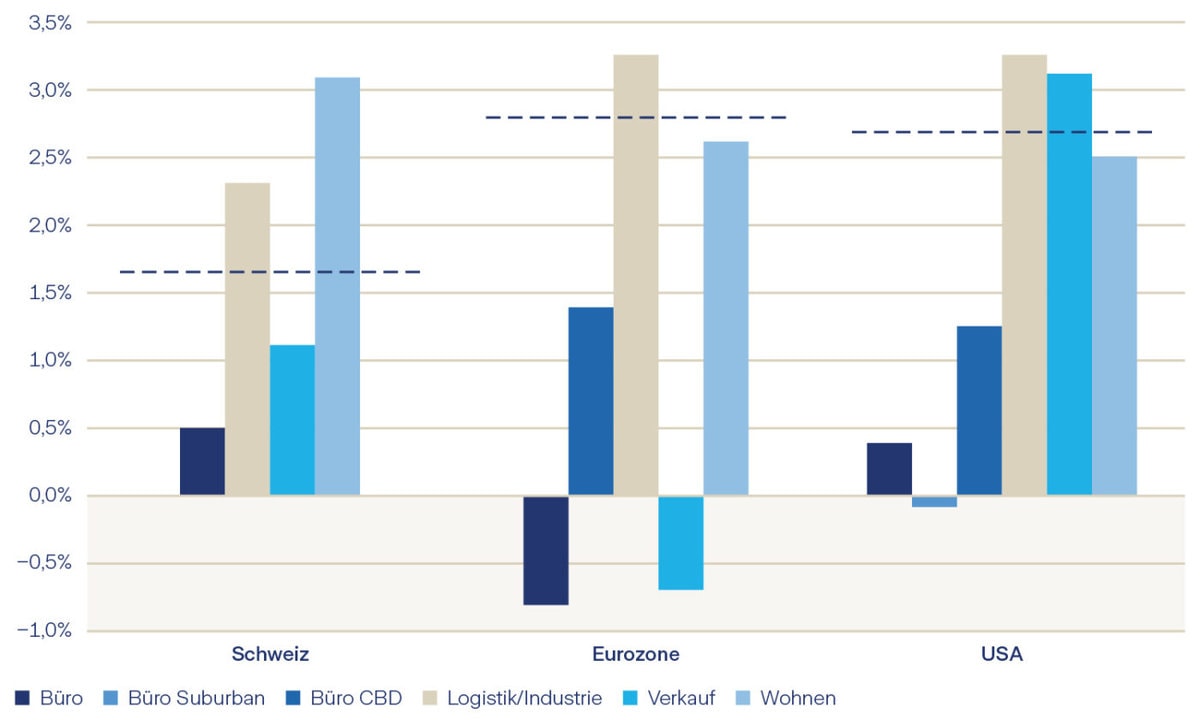

Forecasted rental growth

Rents in the logistics and residential sectors will outpace inflation in all three core markets over the next three years. As the supply and demand situations differ significantly, a detailed analysis of the respective submarkets is essential. In the residential sector, the issue of affordability needs to be specifically considered.

Fundamental data show the way

In order to identify regional and sectoral trends, Zurich Investment Foundation is increasingly looking at socio-economic factors. Political decisions, interventions in the market economy, tax adjustments and investments in social infrastructure have a direct influence on regional demographic trends. Accordingly, the Zurich Investment Foundation takes these factors into account in its macroeconomic model in order to identify attractive growth markets at an early stage.

Low debt ratio gives stability and room for maneuver

After low financing costs tempted to leverage the historically low purchase yields, increased refinancing costs are now impacting net income and portfolio valuations. However, the number of "distressed" sales varies by market and region. While non-performing loans are on the rise in the USA, there are only isolated sales of properties in Switzerland due to non-performing loans.

In addition to stability in a dynamic market, the Zurich Investment Foundation's low leverage strategy creates room for maneuver to contain risk and opportunities to make the most of market-driven opportunities. The expected higher returns therefore offer interesting opportunities for investors with strong capital.

Risk mitigation through active sustainability management

As a result of the EU Taxonomy Regulation, there is increasing pressure worldwide to give greater consideration to sustainability in real estate. As tenants also attach importance to this, low-consumption and socially responsible properties will become the industry standard in the medium term. Properties that do not meet these requirements are increasingly viewed negatively.

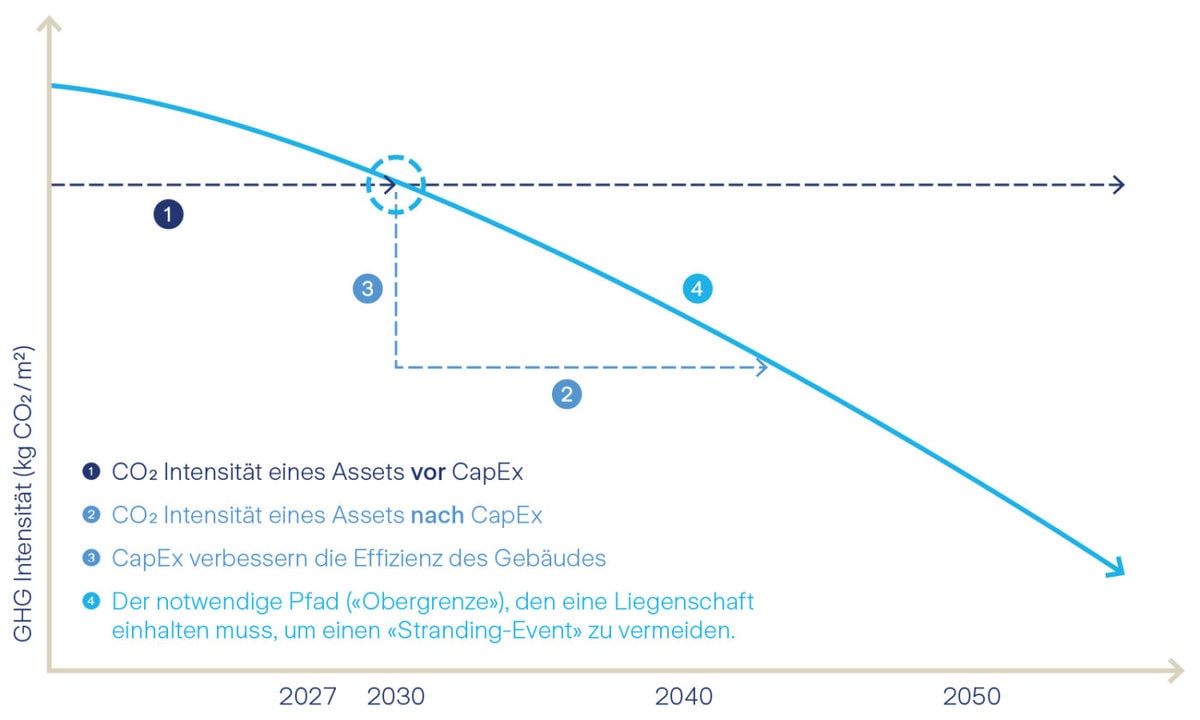

Lowering path of an object to avoid a stranding event

To avoid vacancies, unexpected costs and stranded assets, a professional asset management plan combining environmental and economic aspects is required for each property. In order to achieve the reduction of CO2-In order to safeguard the value of the investment during the holding period, investments must already be priced in during the purchase or valuation process. These investments also have a value-enhancing effect due to more efficient operation and higher rental income.