Avobis - your partner in turbulent financing times

Real estate financing is proving to be complex and expensive in a rising interest rate environment and with cautious lenders. This is where Avobis comes in.

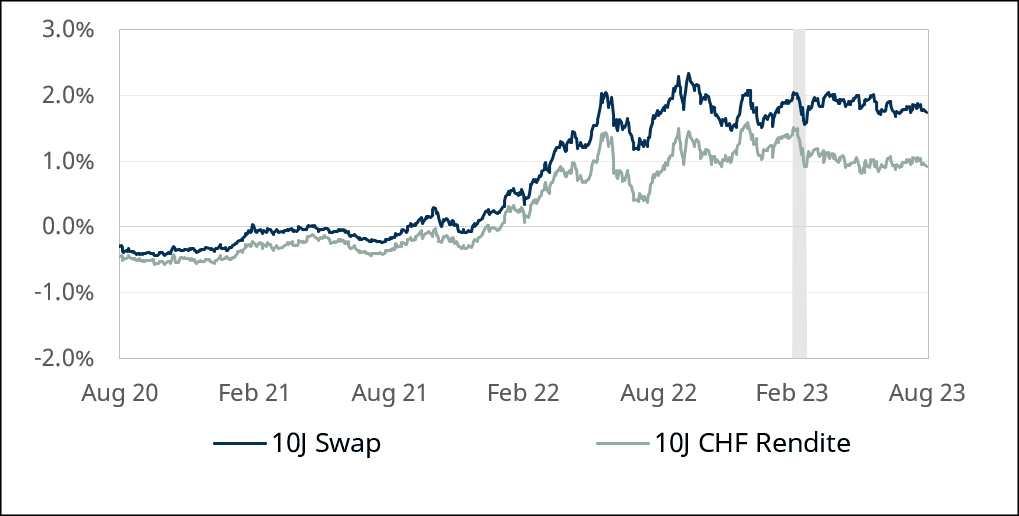

Increased risk premiums are a key indicator of the growing reluctance of lenders. The uncertainty surrounding the takeover of CS by UBS has increased risk in the banking sector. This is manifested above all in the increased swap spreads, which reflect the difference between the swap rate and the yield on German government bonds.

Source: Refinitiv Eikon, as at 28.08.2023

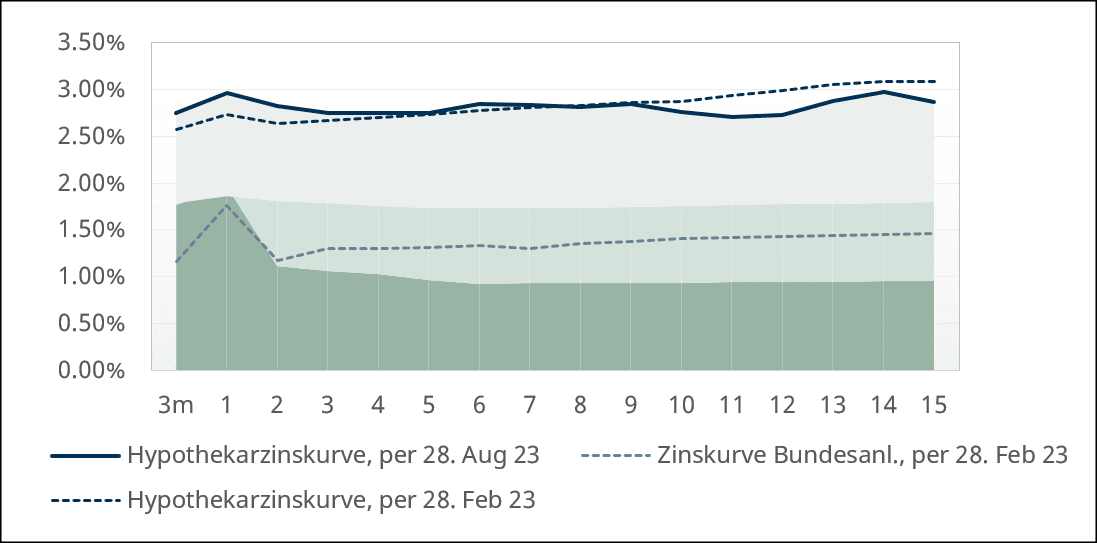

Furthermore, banks not only pass on this premium to borrowers, but also other market risks. They do this by charging a higher credit margin, which - despite falling bond yields - leads to persistently high lending rates.

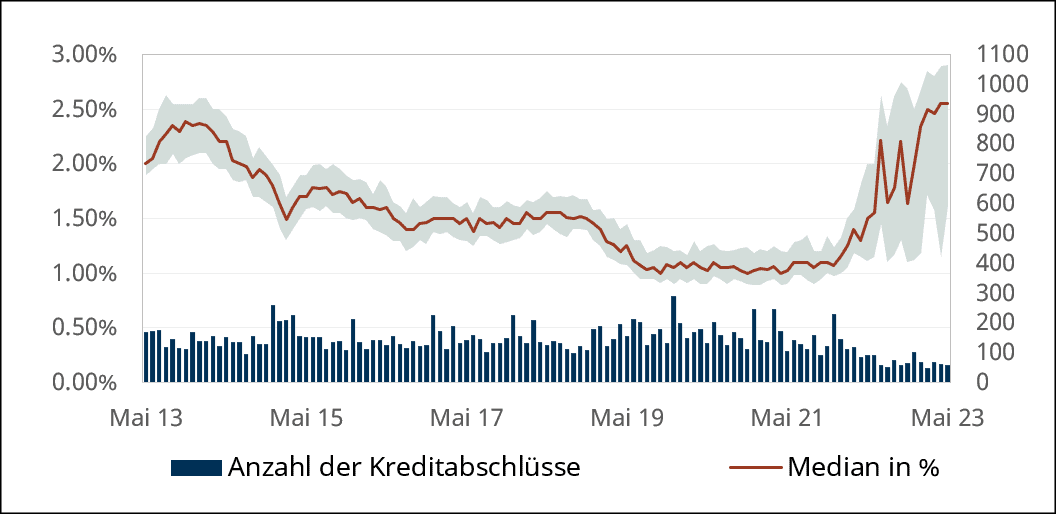

Banks are becoming more selective

Many banks no longer expand their mortgage business beyond their core area and focus exclusively on their main areas. Such an approach deprives the market of a competitive share and weakens the negotiating position of borrowers. While lending guidelines were often perceived as too restrictive in the low interest rate environment and were therefore circumvented by loans that are considered exception-to-policy, they are now being followed more consistently. The stricter adherence to internal bank guidelines regarding loan-to-value ratios, affordability rules and amortization rates restricts the scope of action of mortgage borrowers and, in extreme cases, can lead to a rejection of the loan application.

Professional approach and active market presence required

The central banks are unanimously signaling a restrictive monetary policy for the unforeseeable future, which further complicates the situation. In this market environment, it is becoming increasingly challenging to secure seamless refinancing for their real estate projects, even for well-connected players in the real estate market with an affinity for financing. The realization of construction and other investment projects is also facing growing difficulties when it comes to securing the necessary financing and implementing the projects profitably.

In the midst of the current market uncertainty, it is essential to critically review your own financing structure, even for existing loans, and to adapt it to the changing framework conditions and requirements if necessary. Especially in such an environment of increased and volatile interest rates, the market demands an active presence and a professional approach in order to be successful. Avobis supports and advises on all these issues with its experts and its large network of lenders in all financing matters.

Source: Refinitiv Eikon, SNB, as at 28.08.2023

Mezzanine financing: Another option when nothing else works

In addition to conventional bank financing, there are alternative financing models such as mezzanine financing. This subordinated loan can be particularly suitable for securing liquidity or as bridge financing. Due to the associated risk, this form of capital procurement can be costly. A professional tendering process for financing and a thorough comparison of offers are therefore crucial.

Although mezzanine financing is legally classified as debt capital, which means that interest expenses are tax-deductible, tax authorities may question the conditions of such financing. This is particularly the case if the loans originate from related parties or shareholders. In these situations, it may be necessary for the borrower to prove that the financing conditions are in line with market conditions.

Avobis has many years of experience in arranging debt capital, including mezzanine financing. Thanks to this expertise and its excellent network in the market, Avobis can provide support in the procurement of mezzanine financing as well as a detailed analysis of the market standard of the underlying financing.

We create liquidity and flexibility in these uncertain times and are at your side as a reliable partner. Contact us and let us find your financing solution together.

Avobis Group AG

Brandschenkestrasse 38

8001 Zurich

Financing | Avobis

finanzierungen@avobis.ch