Real estate as an important portfolio stabilizer

In the last two years, real estate investors have been confronted with strong influences such as the inflation trend and the interest rate turnaround. Is real estate still a stable asset class?

At 1.2%, inflation was back within the SNB's target corridor in February 2024 and the lowest it has been since October 2021. A strong Swiss franc and falling consumer goods prices are reducing inflation. Although price stability now prevails according to SNB criteria, the monetary policy situation must continue to be monitored.

Investment foundations defy the difficult market environment

Rising inflation since 2022 led to the first key interest rate hike in Switzerland since 2007. The interest rate sensitivity of Swiss real estate funds and high valuations led to a sharp correction in 2022. The overall performance of listed real estate funds fell by 15 percent in 2022 as measured by the SXI Real Estate Funds Broad Total Return. In 2023, the indirect real estate market trended sideways. However, the turbulent times now seem to be over.

Development of the Swiss real estate market - indexed since December 31, 2007

The real estate ratios in the portfolios rose above the strategic or regulatory upper limits in some cases due to sharp corrections in equities and bonds. Some investors had to reduce their exposure to liquid real estate securities, which exacerbated the slump in 2022. Investor sentiment and market turbulence significantly reduced the flow of capital into the investment vehicles.

Unlike listed real estate funds, unlisted real estate was more robust as measured by the KGAST Immo Index. Real estate investment foundations did not react as directly to the interest rate turnaround as listed real estate investments.

Increase in real estate allocation

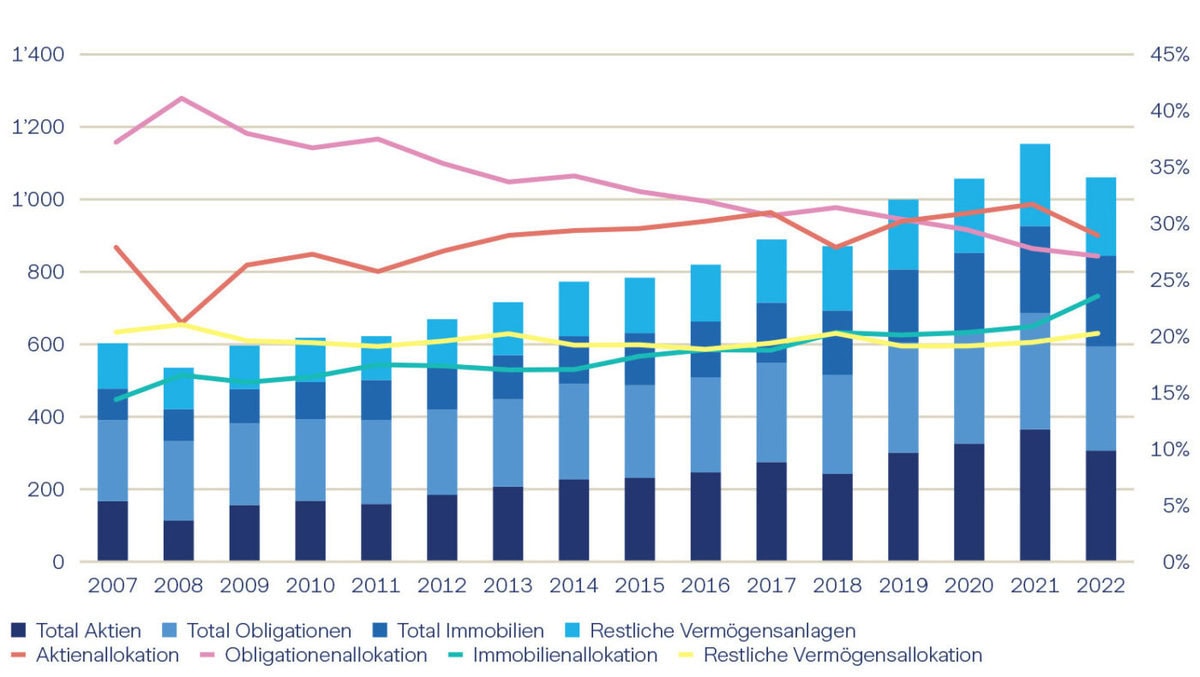

According to the Federal Statistical Office, the proportion of real estate in the portfolios of Swiss pension funds has steadily increased from around 15 percent to almost 24 percent of total pension fund assets between 2007 and 2022.

Investments of Swiss pension funds in CHF billion

While the proportion of equities also rose slightly from around 28% to just under 29% during this period, the proportion of bonds fell sharply from over 37% to 27%, partly due to negative interest rates.

Real estate therefore makes a significant contribution to asset protection and the performance of pension funds.

Contradictory factors are present

The value of Swiss real estate is currently determined by conflicting factors. Although immigration from abroad is supporting rental demand, particularly in central urban locations, there is no increase in supply. Construction activity is even declining.

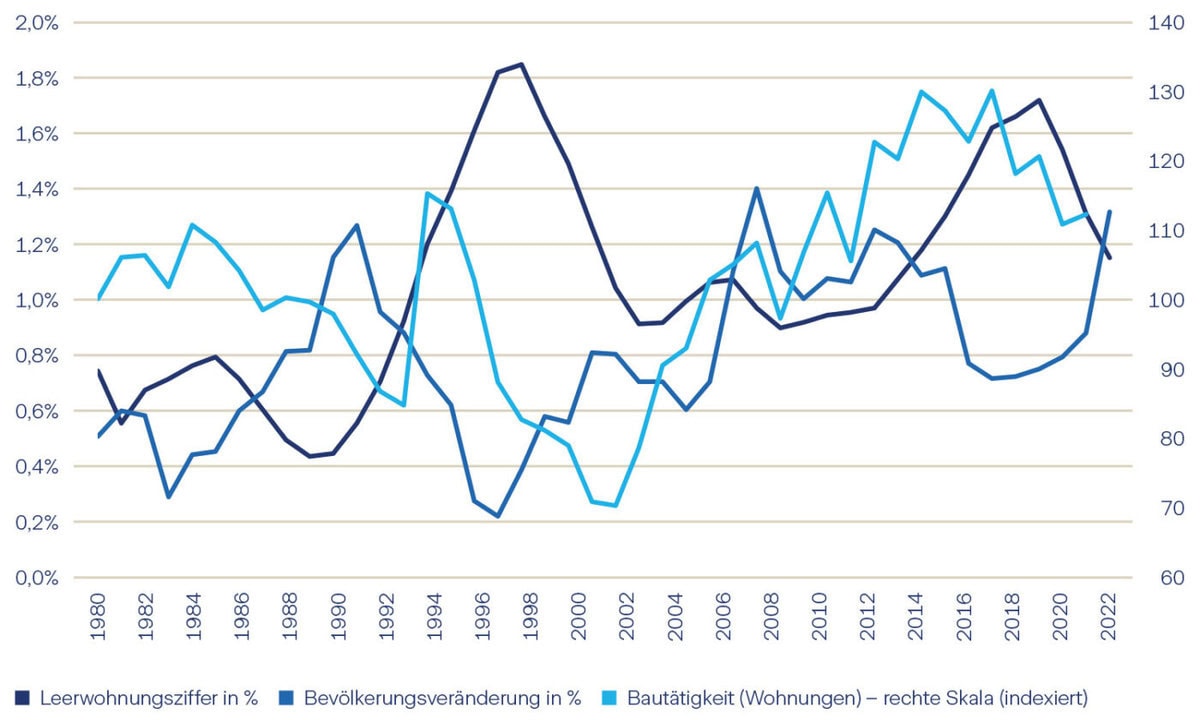

Vacancy rate, change in resident population and newly built apartments in Switzerland

The reduction in construction activity, which is reflected in a decline in building permits, leads to potentially rising rents and higher income for owners. While property prices came under pressure in 2023 due to high interest rates and financing costs, there are signs of an easing in 2024. Yields on 10-year Confederation bonds fell from 1.1% in mid-March 2023 to 0.7% in mid-March 2024. Even if the markets expect inflation and key interest rates to fall, the probability and speed of monetary easing could be overestimated, meaning that only two interest rate cuts are currently expected in 2024, even if the risk has shifted towards a more accelerated cycle of interest rate cuts by the SNB.