ZKB launches new home ownership index ZWEX

Zürcher Kantonalbank has relaunched its price index for the residential property market, the Zürcher Wohneigentumsindex (ZWEX), in an expanded form. According to the index, residential property prices in the canton continued to rise in the third quarter of 2017.

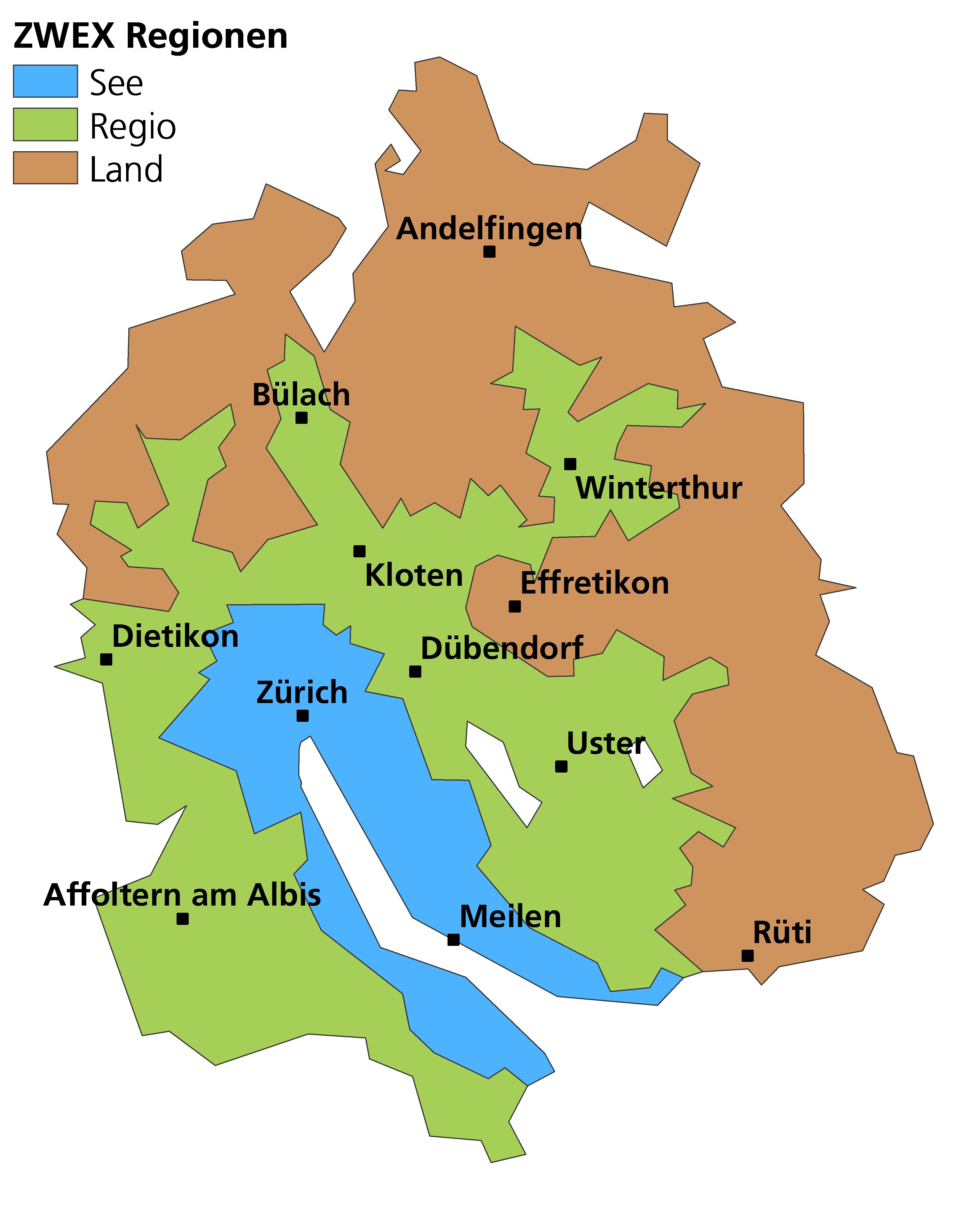

The ZWEX documents the price development of single-family houses and condominiums in the canton of Zurich. It consists of an overall index as well as three new regional sub-indices: lake, region and country. The regionalization is based on the spatially different price levels, says the Zürcher Kantonalbank ZKB. The See region consists of the most expensive localities around the Zurich lake basin, while the Regio comprises the medium-priced, suburban localities in the catchment area of the city of Zurich and Winterthur. The Land region consists of the most affordable localities in the rural areas of the canton.

In the third quarter, ZWEX registered price growth of 1.4 percent for residential property in the canton of Zurich, with the regions developing differently: While the cheapest region, Land, experienced a price increase of 2.7 percent, prices in the Regio region declined slightly (-0.1%). The most expensive region, Lake, recorded price growth of 2.2 percent. The condominium segment, which had already been a key price driver for above-average growth over the past ten years, was particularly responsible for this. Following a period of calm between the end of 2013 and 2015, prices in the canton have risen by 5.3 percent overall since the beginning of the year.

"Price growth in the canton of Zurich is currently taking an intermediate spurt," says Peter Meier, Head of Analytics Real Estate at ZKB. "In the short to medium term, we expect the market to calm down again. For 2018, we expect a slight price decline of 0.5 percent in the canton of Zurich." The decisive factors, he says, are the continued high level of construction activity, the downward trend in immigration and slightly rising interest rates.

More apartments coming onto the market in the long term

In the long term, the ZKB experts expect demographic trends to lead to a renewed increase in home ownership on the market: With the baby boomer generation (born between 1955 and 1965) retiring between 2020 and 2030, there will be a large group of sellers in the home ownership market in the long term, relative to the overall population. On the demand side, however, the potential buyer group, namely the 35 to 45 year-olds, is declining relative to the overall population. In the coming decades, it is therefore to be expected that a larger supply will be matched by a lower demand for home ownership.

The data basis for the ZWEX consists of the freehold transactions of condominiums and single-family houses financed by the Zürcher Kantonalbank. Since 2006, the data have been supplemented with the freehold transactions of the Swiss Real Estate Datapool (SRED). In addition to its own transaction data in residential property, the cantonal bank can now also include those of Credit Suisse and UBS in the index. According to ZKB, this makes it the most comprehensive data source in the canton of Zurich - with around 3,000 transactions per year, it now covers approximately 56 percent of all owner-occupied home transactions in the market. The new index is calculated on a quarterly basis.