HSC Fund invests in Thun

The Helvetica Swiss Commercial Fund (HSC Fund) is buying a mixed-use commercial property in Thun. The seller is Meyer Burger Technology, the purchase price is CHF 42.5 million.

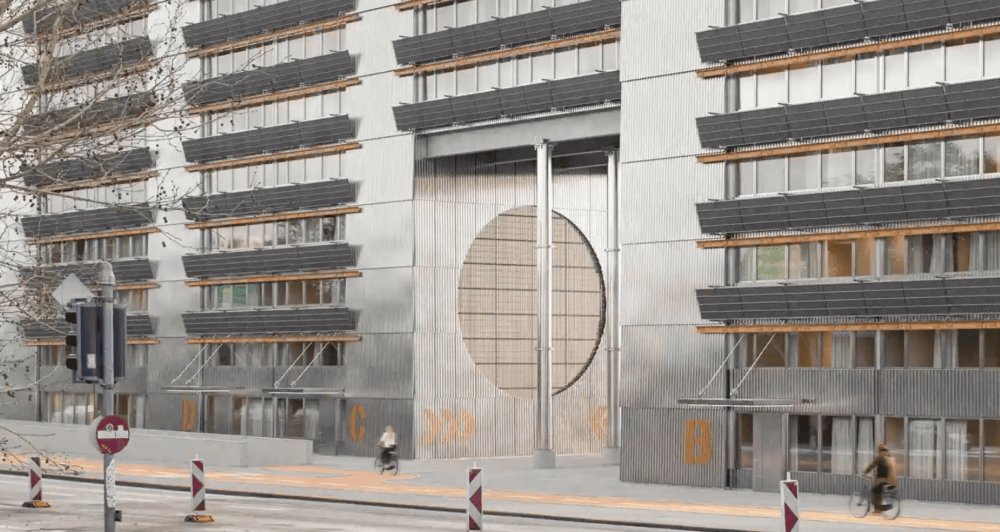

The commercial property is located on Schorenstrasse in Thun, an "extremely good and business-intensive location" according to fund management company Helvetica Property. The leasable area is around 22,900 sqm and the annual rental income is CHF 3.6 million.

The property is leased on a long-term basis and fully occupied, the statement continues. Group companies of Meyer Burger represent a share of around 17% of the rental income. The remaining 83% are generated with various tenants independent of Meyer Burger.

The property was built in 2011 and obtains all its electricity from renewable energy sources, especially hydropower. The building also has its own photovoltaic system and a photovoltaic building facade.

The purchase agreement with Meyer Burger was reportedly notarized on Oct. 22. According to Helvetica Property, the agreement includes long-term rent guarantees and a staggered purchase price payment.

The transaction is still subject to a pre-emptive right of the city of Thun, and the city must also approve the sale. Based on "intensive discussions" with the seller party as well as with the authorities of the city of Thun, it is expected that the transaction will be completed shortly and the transfer of ownership of the property will take place, the fund management continues.

As Hans R. Holdener, CEO and Managing Partner, says, further acquisitions are planned for the fourth quarter of this year. By the end of the year, the market value of the portfolio is expected to reach around CHF 700 million. (ah)