Credit Suisse wants to sell the STCC to the federal government

Credit Suisse and the ETH Board have agreed that the Swiss Tech Convention Center (STCC) will revert to the federal government in the next few years. Two CS funds own the convention center.

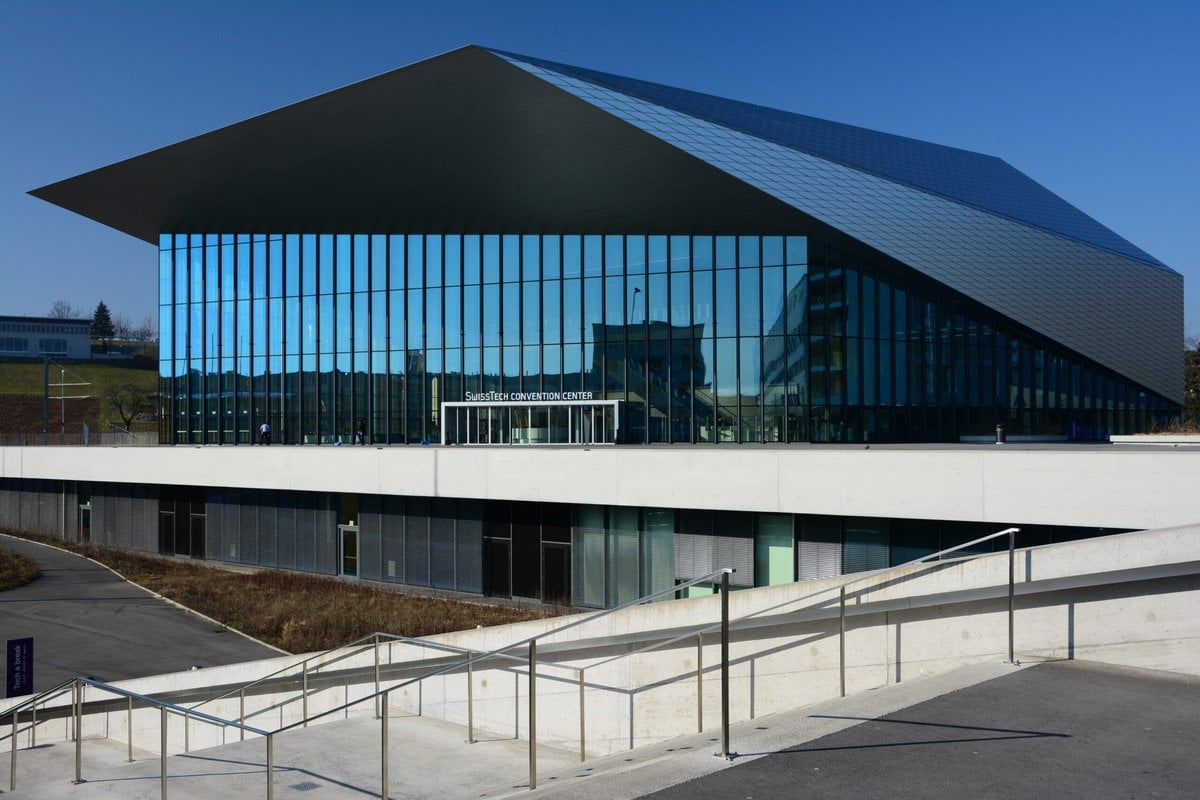

Credit Suisse Funds AG built the Swiss Tech Convention Center (STCC) in Ecublens together with the adjacent Centre de Logement in 2010 as part of a public-private partnership. The real estate funds Credit Suisse Real Estate Fund Livingplus and Credit Suisse Real Estate Fund Hospitality each have an equal investment in the properties. The sole tenant is the Swiss Federal Institute of Technology Lausanne (EPFL), and the lease for both buildings was originally to run until 2044. According to earlier information, Credit Suisse invested CHF 120 million, and EPFL pays an annual rent of CHF 6 million.

As Credit Suisse has now announced, talks have been underway for some time about an early reversion of the STCC. For EPFL, the congress center is important for teaching and research. However, it has not been able to operate profitably since it opened in April 2014, and this problem has been exacerbated by the corona pandemic, according to Credit Suisse.

The funds retain the Centre de Logement

Credit Suisse Funds and the ETH Board have therefore agreed that the SwissTech Convention Center should be transferred to the federal government as part of an early reversion. The building lease is to be divided into two parts, one for the STCC and one for the Centre de Logement. While the share with the STCC will be transferred to the federal government, the funds want to keep the building lease property with the Centre de Logement, which includes student apartments, stores, a hotel and a parking garage. The lease with EPFL has been extended by ten years to 2054.

Credit Suisse puts the transaction amount at CHF 139.5 million, which is on a par with the market value at the end of 2021. The Federal Council and the Federal Assembly still have to approve the transfer of ownership; it is to take place from 2024 to 2026 at the latest. During this time, the real estate funds intend to make replacement investments.

The STCC accounts for 2.3% of total fund assets for Credit Suisse Real Estate Fund Livingplus; for Credit Suisse Real Estate Fund Hospitality, this figure is 9.0% (as of December 31, 2021).

Filippo Rima, CEO of Credit Suisse Asset Management Switzerland, says they welcome the solution, in which the real estate funds involved "will be compensated with an attractive price for the SwissTech Convention Center and, in addition, the lease term of the Centre de Logement will be extended by ten years". The proceeds for the STCC are to be invested in other properties.

Matthias Gäumann, EPFL's vice president for operations, says the transfer will significantly reduce the operating costs of the currently loss-making congress center. This would also improve the framework conditions for EPFL to exploit the potential of the infrastructure. (ah)