Solvalor 61 invests in western Switzerland

The Realstone fund has acquired two residential properties in Carouge and Geneva for a total of CHF 24 million.

The Solvalor 61 fund is strengthening its presence in the Geneva area. According to the fund management company Realstone, two residential properties were added to the fund's portfolio in the first half of the year for a total investment of CHF 24 million. These are high-quality properties comprising a total of 50 apartments and almost 3,000 square meters of living space.

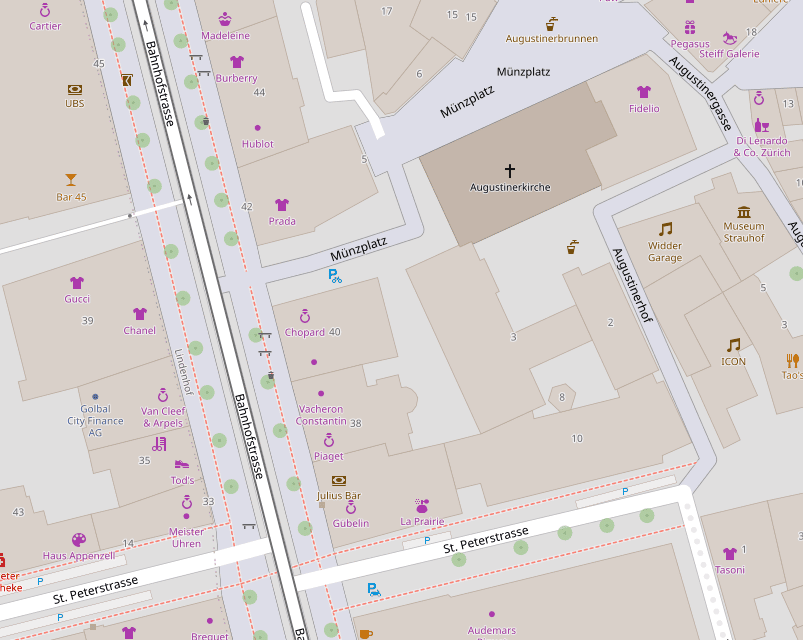

One of the properties is located at Rue de la Filature 42 in Carouge, the other at Avenue Peschier 20 in the popular Champel district of Geneva. The adjacent property at Avenue Peschier 22 is already owned by the fund.

According to Realstone, the average gross yield is 3.7% on the current rent roll and almost 5.9% on a potential rent roll. The rental reserve of the properties is over 50%. The fund management is convinced that this will lead to a considerable increase in value in the future. The current rental income amounts to CHF 0.9 million; Realstone estimates the potential tenant value at current market rents at CHF 1.4 million.

With these two new acquisitions, Solvalor 61 has made purchases with a volume of CHF 36 million so far in the 2022/23 financial year - at the end of 2022, the fund purchased a property in Montreux for CHF 12 million. According to the fund management company, further acquisitions are planned, with a focus on high-quality properties in the center of western Switzerland with high rental reserves. (ah)