UBS: Bubble Index falls again

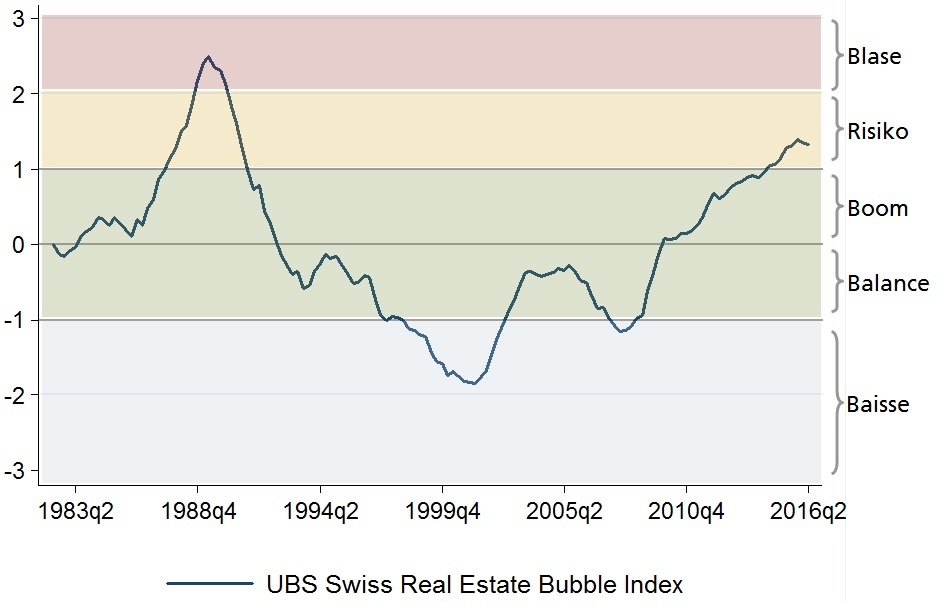

The UBS Swiss Real Estate Bubble Index fell slightly for the second time in a row in the second quarter of 2016. However, it remains in the risk zone.

UBS's real estate bubble index stood at 1.32 index points in the second quarter of 2016, putting it in the risk zone. Compared with the previous quarter, the index fell by 0.03 points.

In the view of UBS researchers, two factors favored the slight decline: First, nominal home prices stagnated compared with the previous quarter, corresponding to a decline of 0.6 percent after adjustment for inflation. On an annual basis, this was the lowest growth rate since 2000. Second, the momentum of mortgage growth also weakened. According to the data, household mortgage debt rose by only 2.7 percent year-on-year - also the slowest pace since the turn of the millennium.

Real estate investments remain popular

In the second quarter, the share of loan applications for properties not intended for own use remained at almost 18 percent. "Real estate investments thus continued to enjoy great popularity, as also confirmed by the figures for building permits," comment the experts at UBS. In the first half of the year, building permits were issued for almost 30,000 apartments, about eight percent more than in the same period last year.

The UBS Swiss Real Estate Bubble Index is composed of six sub-indices: Ratio of purchase prices to rental prices, ratio of house prices to household income, ratio of house prices to inflation, ratio of mortgage debt to income, ratio of construction activity to gross domestic product (GDP), and ratio of loan applications submitted for properties intended for rental to total loan applications from UBS private clients. (ah)