ZKB Market Analysis: Apartment Rents under Pressure

According to Zürcher Kantonalbank (ZKB), "a considerable oversupply" is building up on the rental housing market. However, the situation varies greatly from region to region.

"Supply and demand in the rental housing market are increasingly diverging," says Peter Meier, head of real estate research at ZKB. Immigration is decreasing, while at the same time many new rental apartments are being built. "This imbalance will lead to falling rents. However, not all regions will be equally affected," says Meier.

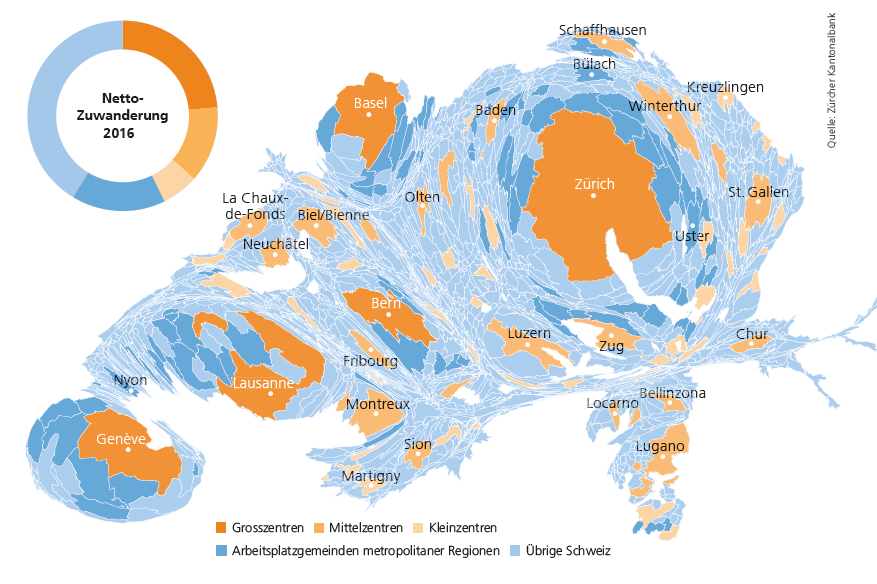

Net immigration mainly affects the centers

Net immigration of the permanent foreign resident population in Switzerland has already been falling since the end of 2014, but the decline has recently become more accentuated: in 2016, immigration was 16 percent below the previous year's figure, and the figures for January to August 2017 show a further decline of 17 percent. However, immigration is distributed very differently from region to region. This is because around 70 percent of net immigration concerns the centers and their agglomeration municipalities.

However, the latest figures now show a different trend for Swiss cities: While immigration has increased slightly again in the five major cities of Zurich, Geneva, Basel, Lausanne and Bern, it is falling sharply in Switzerland's medium-sized and small centers. "The decline in demand will be clearly felt in the rental housing markets there," ZKB researcher Meier is convinced.

Demand and supply diverge

According to the ZKB market analysis, a comparison of immigration and building permits shows that demand and supply have diverged, especially since the decline in immigration in mid-2015. Of the total housing production, more and more is also accounted for by rental apartments. This is a consequence of the stricter financing guidelines and the resulting more difficult sales of residential property, explains Meier. In addition, there is a very high demand from investors for multi-family houses. A more critical factor is the high level of new construction activity combined with high vacancy rates.

According to ZKB, the outlook for the Swiss rental housing market is "mixed". In some regions, however, it is not even necessary to look into the future to identify problems with rentals. A good indicator to determine high-risk markets, he said, is the key figure of rent adjustments, newly calculated by the banking institution: This ratio has risen significantly on average in Switzerland in recent quarters and currently stands at nine percent. In the canton of Zurich, the city of Zurich and Winterthur showed only a few rent reductions in the first half of 2017. By contrast, higher values were seen in the Bülach region, Knonaueramt and Weinland.