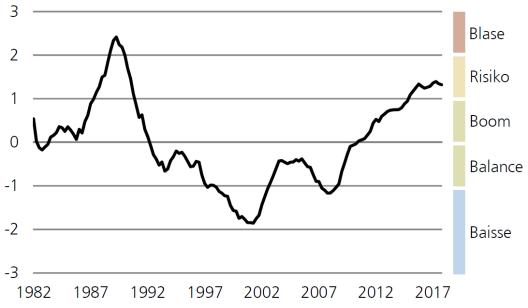

UBS Bubble Index falls again

The real estate bubble index compiled by UBS Swiss Real Estate declined for the second time in a row in Q4 2017. However, it remains in the risk zone.

The UBS Swiss Real Estate Bubble Index currently stands at 1.32 index points and thus in the risk zone. The decisive factor for the second decline in a row is the continued low growth of household mortgage debt in the banking sector with simultaneous robust income growth in the last quarter, says UBS.

Household mortgage debt rose by 2.6 percent last year, well below the average of 3.8 percent over the past ten years. However, the volume of outstanding mortgages may have grown somewhat more strongly in reality than the data suggest, write the UBS researchers. This is because insurers and pension funds have issued more mortgages in recent years.

Although their market share is only around five percent, the mortgage positions of insurers have grown twice as fast as those of banks over the past three years. The mortgage books of pension funds also increased significantly from 2016 after several years of decline. "The housing bubble index is thus likely to slightly underestimate the actual risks at the moment," the analysts said.

The price of owner-occupied homes rose by around 0.4 percent in the 4th quarter of 2017, somewhat more than in the previous two quarters, which is why the Bubble Index did not fall more sharply. This would have been expected because, on the one hand, general inflation stagnated at the level of the previous quarter and, on the other, asking rents fell by 0.4 percent.

The price/rent ratio is thus rushing from peak to peak. According to UBS, it now takes more than 30 years' rent to buy a home. The highest price/rent ratios are found in the risk regions of German-speaking Switzerland (Basel-Stadt, Lucerne, Zug and the Zurich conurbation) and in the tourist regions. Here, an owner-occupied home sometimes even costs more than 35 annual rents.