Owner-occupied homes: Bubble index rises, but no correction in sight yet

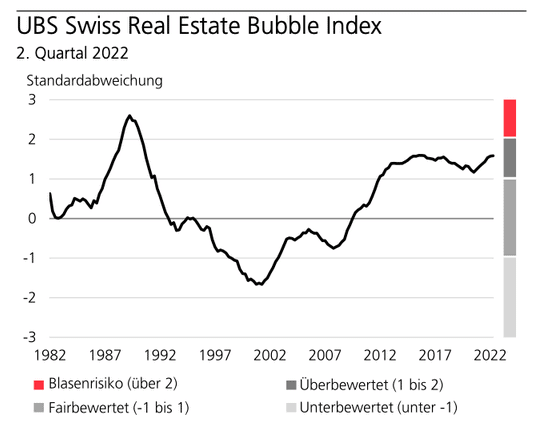

The UBS Swiss Real Estate Bubble Index is still significantly lower than in the 1990s, but shows a clear overvaluation.

The UBS Swiss Real Estate Bubble Index rose only marginally in Q2 2022, from 1.57 to 1.58 points. However, because the previous quarter's figure was revised upward significantly due to revised household income data, the owner-occupied housing market is overvalued compared with its own history. This implies an increased potential for correction in the event of a prolonged economic crisis or if interest rates continue to rise. However, the bubble index is still significantly lower than during the real estate bubble at the beginning of the 1990s.

Higher long-term interest rates are indeed putting pressure on the attractiveness of buy-to-let investments and, according to UBS, have reversed the previous cost advantage of owner-occupied homes over rental apartments. This is dampening demand for owner-occupied homes. However, a price correction is unlikely in the next twelve months due to the low supply on the owner-occupied housing market, it said. (aw)