Raiffeisen: Home buyers switch to money market mortgages

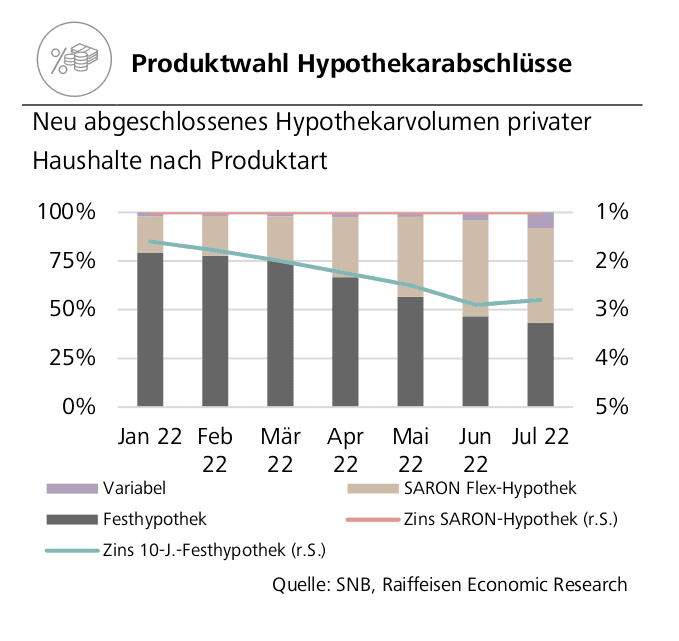

Before the rise in interest rates, 80% of home buyers opted for fixed-rate mortgages, according to Raiffeisen. The picture has turned around rapidly.

The Swiss owner-occupied housing market has so far been unimpressed by the turnaround in interest rates. According to Raiffeisen Switzerland, however, the higher interest rates have had an impact on the choice of financing product when buying a house or extending an expiring mortgage. Money market mortgages, for example, had replaced fixed-rate mortgages as the most popular form of financing for home ownership. Before the rise in interest rates, 80% of new mortgages were taken out by private borrowers with fixed interest rates, according to Raiffeisen. "Virtually one-to-one with the rise in capital market interest rates, however, the picture changed significantly in subsequent months," it said in a Raiffeisen market analysis. In June and July, more money market mortgages ("Saron hyptheks") than fixed-rate mortgages were concluded for the first time, it said.

The reason for this development is obviously that the increase in interest rates only had a significant impact on long-term interest rates, while money market mortgages continued to be available at favorable rates. "The first interest rate step of the National Bank has not yet changed this circumstance," writes Raiffeisen. Only when the key interest rate turns into positive territory, Saron mortgages would also become more expensive. According to the data, the maturities of fixed mortgages have also decreased significantly. Since May, the term of only 33% of the fixed-rate mortgages was eight years or longer. (aw)