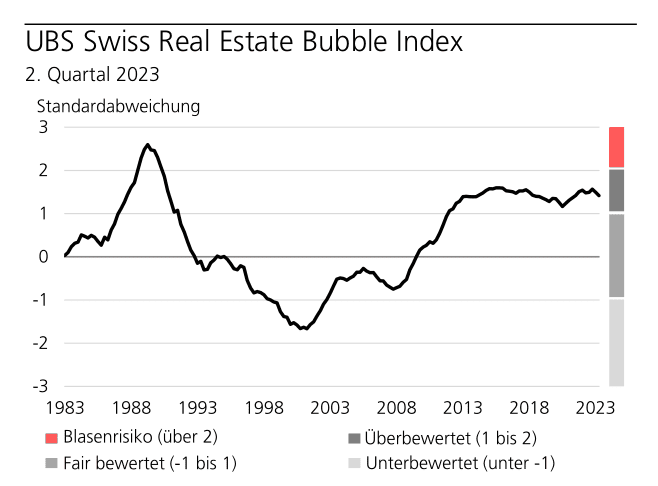

UBS Bubble Index fell slightly in the 2nd quarter

Although residential prices rose more sharply in Q2 than recently, the risks on the Swiss real estate market have diminished somewhat, according to UBS.

The UBS Swiss Real Estate Bubble Index fell from 1.49 to 1.41 points in the second quarter. "Nevertheless, the real estate market remains overvalued relative to its historical development," write the UBS analysts. However, the significant slowdown in the increase in mortgage debt, fewer applications for buy-to-let financing and the slump in construction investment have led to a reduction in risks on the owner-occupier market. The ratio of home prices to consumer prices, rents and income rose slightly in the past quarter despite the key interest rate hike, which prevented the index from falling more sharply.

The UBS Swiss Real Estate Bubble Index is still significantly lower than during the real estate bubble at the beginning of the 1990s. However, the index value has risen significantly since mid-2020. At 0.8 %, residential property prices also rose more strongly in the second quarter than in previous quarters. Although the rise in asking rents accelerated to just under 1%, it was slightly below the price increase for comparable condominiums. As a result of higher financing costs, the volume of outstanding mortgages rose more slowly than at any time since the 1990s. The economic slowdown also led to slower growth in household incomes than in previous quarters.

According to UBS, home prices are still relatively resistant to rising financing costs. Falling transaction volumes and rising supply point to falling demand for owner-occupied homes. "However, an overall low and further decline in new construction activity makes a significant price correction unlikely in the near future." (aw)