Outlet centers on the rise again in Europe

Factory outlet centers are considered to be extremely resilient to e-commerce and are growing more strongly again after a dip, according to the latest Ecostra study. Another trend: well-known players are looking to enter the market.

Following a dip in growth after the pandemic, with the delayed effects of the coronavirus crisis becoming apparent, the market for outlet centers in Europe is picking up speed again. This is the conclusion of the latest report by German retail consultancy Ecostra. The recognizable growth signals of this retail format, which had previously proved immune to e-commerce competition, are still comparatively modest in quantitative terms. However, projects in the development pipeline point to stronger growth in the future, according to Ecostra.

Retail space grows by 7.6%

In the last twelve months, the number of factory outlet centers in Europe rose slightly on balance to 198 centers in operation (+0.5%). In contrast, their total sales space grew significantly more strongly in the same period by around 7.6% to just under 3.3 million square meters. One of the most significant new openings was the "Designer Outlet Paris-Giverny" in Douains (France), which was realized by the European market leader McArthurGlen directly on the freeway between Paris and Le Havre. In contrast, the Ecostra researchers excluded the almost empty outlet center in the Bulgarian city of Sofia from the statistics. However, a modern and high-quality replacement is already being built in the region.

Players looking to enter the industry

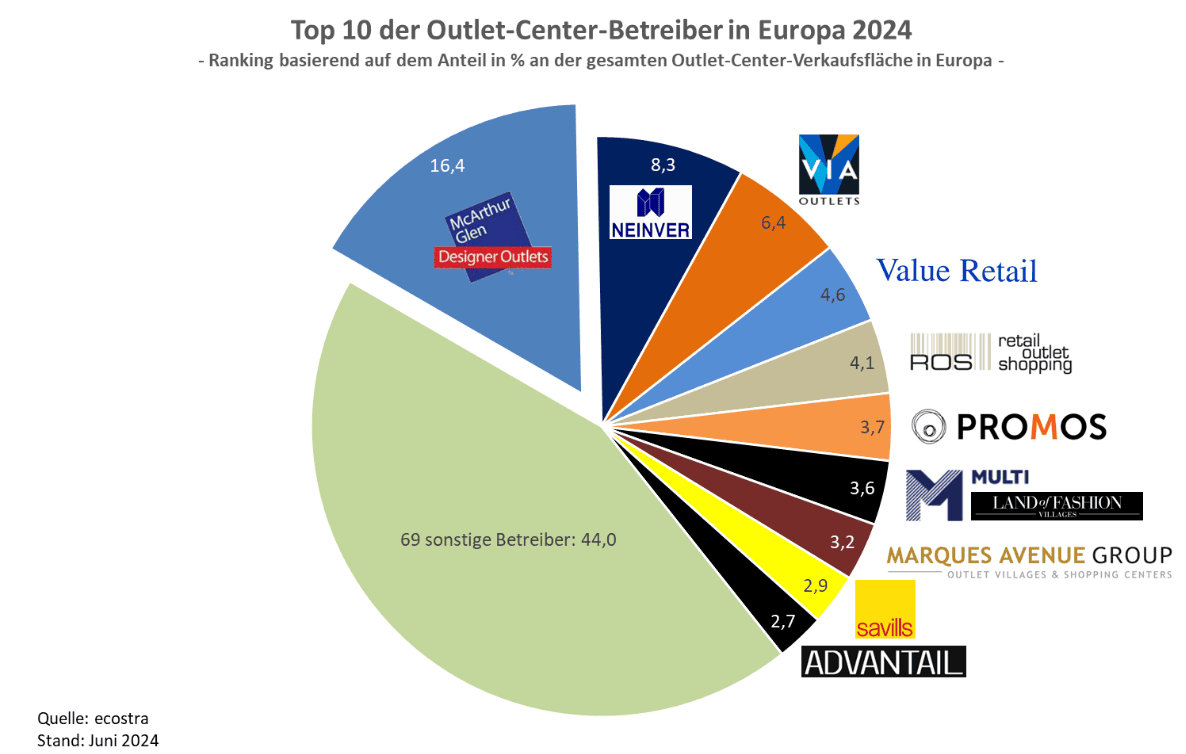

There is also movement in the market on the operator side. A few days ago, the takeover of the Austrian operator Retail Outlet Shopping (ROS), number five in the market, by the French project developer and investor Frey SA was completed. According to Ecostra, the Frey Group had been looking to enter the outlet market for some time. Frey has also already made a find on the property side. The "Malmö Designer Village", which is currently under construction in Sweden, was recently acquired by the British developer Rioja Estates. This center, with a rental area of around 18,000 sqm, is scheduled to open in the second half of 2026.

According to Ecostra, there was another significant development in the transaction market. In the premium segment, British investor Hammerson plc, the most important shareholder in Value Retail's centers, sold its shares at the end of July 2024. The transaction volume for this deal alone amounts to around EUR 1.7 billion and is probably the largest single transaction in the European outlet market to date. Ecostra CEO Johannes Will assumes that Hammerson's capital requirements in other asset classes - especially shopping centers - are the reason for the sale of these "jewels". The buyer, the US investment fund L Catterton, belongs to the sphere of influence of Bernard Arnault, head of the luxury group LVMH.

Trend: Shopping centers change tack

The pipeline for new outlet centers in Europe is currently rather limited, with expansions of existing centers dominating. In Germany, for example, there are particularly high hurdles for this form of retail. For example, the authorities recently rejected the expansion plans for the "Designer Outlet Soltau" in northern Germany. This was to be expanded by 5,000 to 15,000 square meters. The expansion plans at the Zweibrücken and Montabaur locations (both in Rhineland-Palatinate), on the other hand, appear to be going ahead as planned.

Another trend in response to restrictive building legislation is the conversion of parts of struggling shopping centers into outlets. The conversion of around 9,000 m² of space in the Huma shopping center in Sankt Augustin near Bonn (Germany) is the most advanced in this respect. The outlet level planned there is due to open in November of this year. Will reports that several shopping centers are thinking in this direction. Outlet stores are often the only way to fill space. Hybrid concepts consisting of traditional shopping centers and outlet centers have long been established in various European countries.

According to Ecostra statistics, Switzerland is one of the ten markets with the strongest presence of the format, with five outlet centers and a sales area of 77,500 m². Ecostra is rather cautious about the prospect of further growth in Switzerland. Switzerland is classified in the report as showing a slight downward trend in the outlet market. (aw)