SRESI: Sentiment on the investment market improves again

Sentiment on the Swiss real estate investment market is slightly positive again. After two subdued years, KPMG Switzerland's "Swiss Real Estate Sentiment Index" (SRESI) has risen markedly - despite a significantly more negative assessment of the future development of the economic situation.

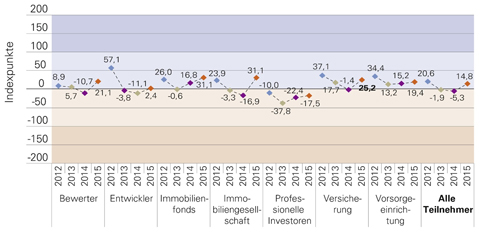

This ambivalent mood can be attributed to the abolition of the minimum exchange rate for the Swiss franc and the introduction of negative interest rates, according to the report. The aggregate SRESI across all participant groups stands at 14.8 index points. This represents a significant improvement of 20.1 points compared with the previous year. This was due in particular to the sub-indicator "price expectations for investment properties," according to KPMG.

At -45.2 index points (2014: 10.1 points), however, the survey participants' assessment of the development of the economic situation is significantly more negative than in 2014. More than 50% of respondents expect the economic situation to deteriorate in the coming twelve months.

Meanwhile, the price indices for central locations (92.7 index points) have risen further, and a positive price trend is again expected in the mid-sized centers (14.5 points). For central locations, less than 3% of the survey participants expect prices to fall, while the figure for mid-sized centers is around 20%. (mr)

- Further figures and charts of the current "Swiss Real Estate Sentiment Index" (SRESI) from KPMG Switzerland can be found at here.