Investis: Plus in sales and profit

Investis reports an increase in turnover of 4% for the 2018 financial year. Net profit excluding revaluation effect increased by 331TP3k to 36 million.

According to Investis, the turnover generated in 2018 amounted to 197 million after 190 million in the previous year (+4%). EBITDA before revaluations and gains on disposals increased by 6% to 39.7 million (previous year: 37.3 million). Including gains from revaluations and disposals, EBIT increased byT 231 thousand fromT 60.9 million toT 74.6 million.

Consolidated profit fell from 57.6 million in the previous year to 54.4 million. By contrast, net profit excluding revaluation effects rose by 33% from 26.8 million to 35.6 million.

Investments of 242 million

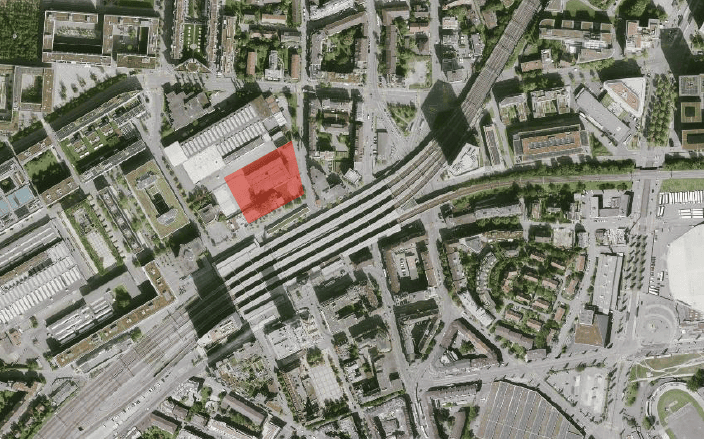

In the Properties segment, 242 million was invested in the portfolio and development projects in the past financial year (previous year: 131 million). Rental income increased byTP3k 161m toTP55.0m in the reporting year (previous year:TP47.5m), which corresponds to an increase ofTP3k 1.71m on a like-for-like basis (previous year:TP3k 1.91m). The vacancy rate fell from 3.5% to 2.9%. The revaluation gain amounted to 24.2 million after 25.0 million in the previous year. Gains on disposals amounted to 12.8 million (previous year: 0.7 million).

According to Investis, the operating result (EBIT) in the Properties segment rose byT 241,000 toT 71.9 million (previous year:T 58.0 million). At the end of the year, the portfolio value increased byTP3 thousand to around 1.35 billion (previous year: 1.12 billion); this is based on an annualized target rental income of 57.7 million. As at the reporting date, the portfolio comprised 157 properties with 2,911 residential units.

Slight increase in turnover for services

At 148 million, sales in the Real Estate Services segment were just above the previous year, Investis also reported. Operating profit (EBIT) amounted to 7.7 million and was therefore slightly below the previous year's figure (7.8 million). The EBIT margin amounted to 5.2% (previous year: 5.3%).

At the Annual General Meeting, which will be held in Zurich on April 29, 2019, the company intends to propose an unchanged dividend of CHF 2.35 per share to shareholders. This corresponds to a dividend payout ratio of 55%. (ah)