Terra Helvetica: New investment foundation launches investment group

The Terra Helvetica investment foundation launches the first issue for the "Wohnen Schweiz" investment group. A volume of up to CHF 60 million is targeted.

Terra Helvetica was established in April 2020 as an investment foundation under Swiss law and is currently launching the first investment group "Wohnen Schweiz" for occupational pension funds in Switzerland. The initial issue has a maximum size of CHF 60 million; payment is planned for the third quarter. The subscription period began on May 15 and runs until July 9. The minimum subscription amount is CHF 100,000; the issue price is CHF 1,000 (plus issue commission).

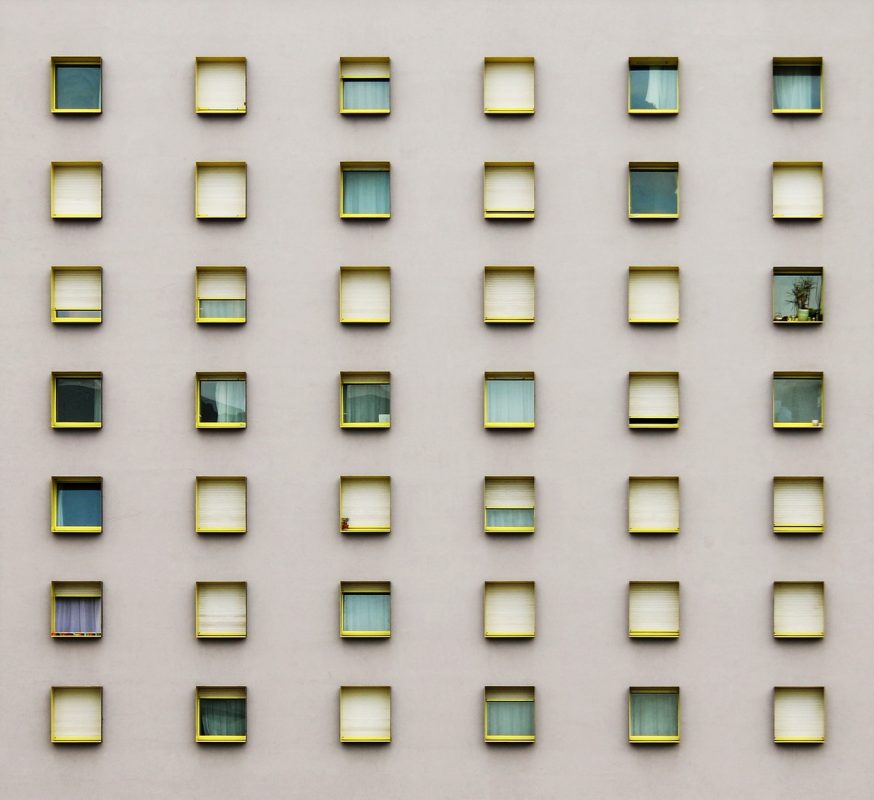

"Wohnen Schweiz" invests directly in real estate throughout Switzerland, with a balanced diversification in terms of regions, locations and types of use, Terra Helvetica says. The share of rental income from residential use is to be at least two-thirds. According to the information, the focus is on existing properties with sustainable earnings prospects or with development potential. In addition, the investment group also intends to invest in new construction and development projects. The selection criteria are the attractiveness and assessment of the infrastructure of the respective locations, their potential as well as the prospects based on the prevailing market cycles, the statement continues.

President of the Terra Helvetica Foundation Board is André Schlatter, attorney and partner of the law firm Grand & Nisple in St. Gallen. Urs Rüdin, member of the Executive Board of Admicasa Management AG, has been appointed Vice President. Terra Helvetica has concluded a mandate agreement with Admicasa Management for the management and administration. The management of the real estate is carried out on a mandate basis by Admicasa Management. Deloitte is the auditor of the investment foundation and Wüest Partner is the independent valuation expert. (ah)