SFP AST Swiss Real Estate fully invested

SFP Investment Foundation Swiss Real Estate raised CHF 38.2 million in its latest capital increase. The new funds have already been fully reinvested.

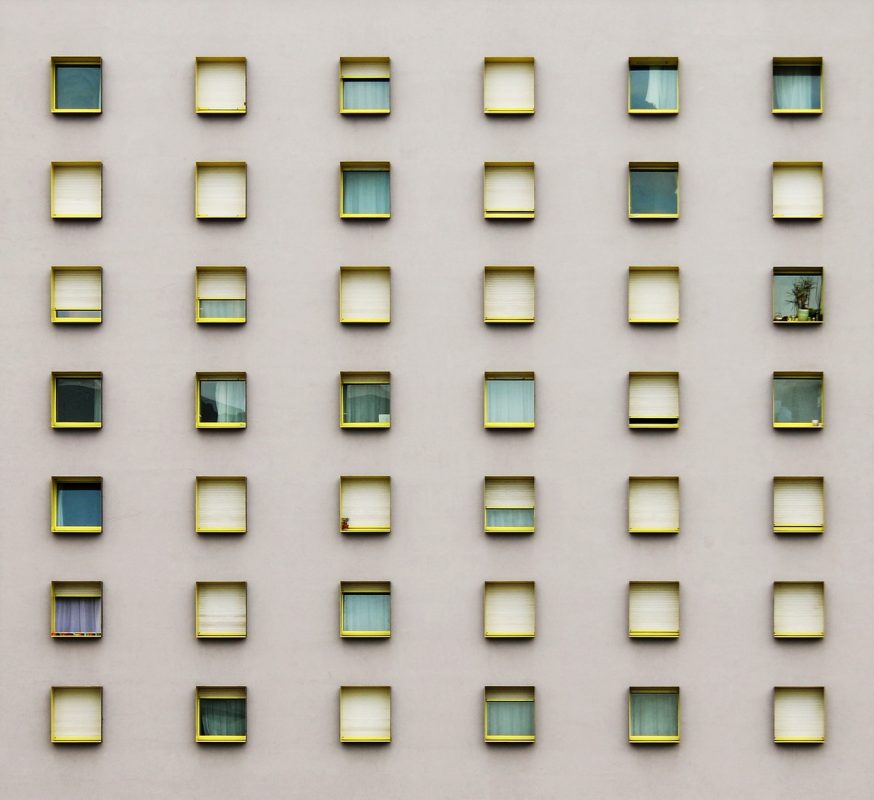

The portfolio now comprises 15 properties with a market value of CHF 199.3 million, according to SFP Anlagestiftung Swiss Real Estate Anlagestiftung. In the current financial year, five properties with a market value of CHF 84.6 million were integrated into the investment group. In addition to four residential properties from the previously announced pipeline, a commercial property in the Zwicky-Areal in Wallisellen was acquired at the end of May.

With a market value of 47.2 million, the gross yield of the property, which was built in 2012 to the Minergie-Eco standard, is 5.3%. The main tenant with a rental agreement until 2032 (option until 2037) is SIS Swiss International Schools Schweiz AG. The remaining space is used by four office tenants, who also have long-term leases. The WAULT for the entire property is around 7.7 years.

With this latest transaction, SFP AST Swiss Real Estate is once again fully invested. The debt ratio is 25.3%. The gross yield of the overall portfolio now stands at 4.1%. Annual target rental income has almost doubled since the beginning of the year and now amounts to 8.1 million. As a result of the acquisitions, the commercial usage share now amounts to 58% and the WAULT has increased from 6 years at the beginning of the year to 6.8 years as at May 2020. (bw)