Swiss Prime Site confirms guidance for 2022

Despite the interest rate turnaround and difficult economic conditions, Swiss Prime Site expects to achieve the targets set for the 2022 financial year, as the real estate company confirmed at its Capital Market Day.

Swiss Prime Site will meet its targets for the 2022 financial year, the real estate company said at its Capital Market Day: assets under management will rise above the CHF 20 billion mark, the vacancy rate will be below 4.4%, funds from operations (FFO I) will increase by at least 5% and LTV (loan to value) will be below 40%.

No major refinancing necessary for the time being

Swiss Prime Site points out that it is "solid and balanced". The debt capital of CHF 5.4 billion (as at June 30, 2022) is well cushioned by a diversified range of instruments. In the third quarter, the two sustainability-linked syndicated loans of CHF 2.6 billion were extended ahead of schedule by one year to 2027/28 at stable margins. There is no need for significant refinancing until 2025.

"Furthermore, in addition to the flexibility in terms of time, possible additional costs of a later refinancing can be well compensated from our point of view by the indexation of business rents, additional income from completed real estate developments within the project pipeline and the prudent capital recycling," said Chief Financial Officer Marcel Kucher.

In the medium term, Swiss Prime Site intends to make its entire corporate financing sustainable. To this end, the real estate company presented its new "Green Finance Framework", which includes sustainably linked loans and other financial instruments in addition to "green" bonds.

Life science industry in focus

Swiss Prime Site currently sees growth potential above all in the life science industry: The sector invests disproportionately in research and technology and is not susceptible to recessionary phases. In Switzerland, there are corresponding clusters above all in the Basel, Zurich and Lake Geneva regions.

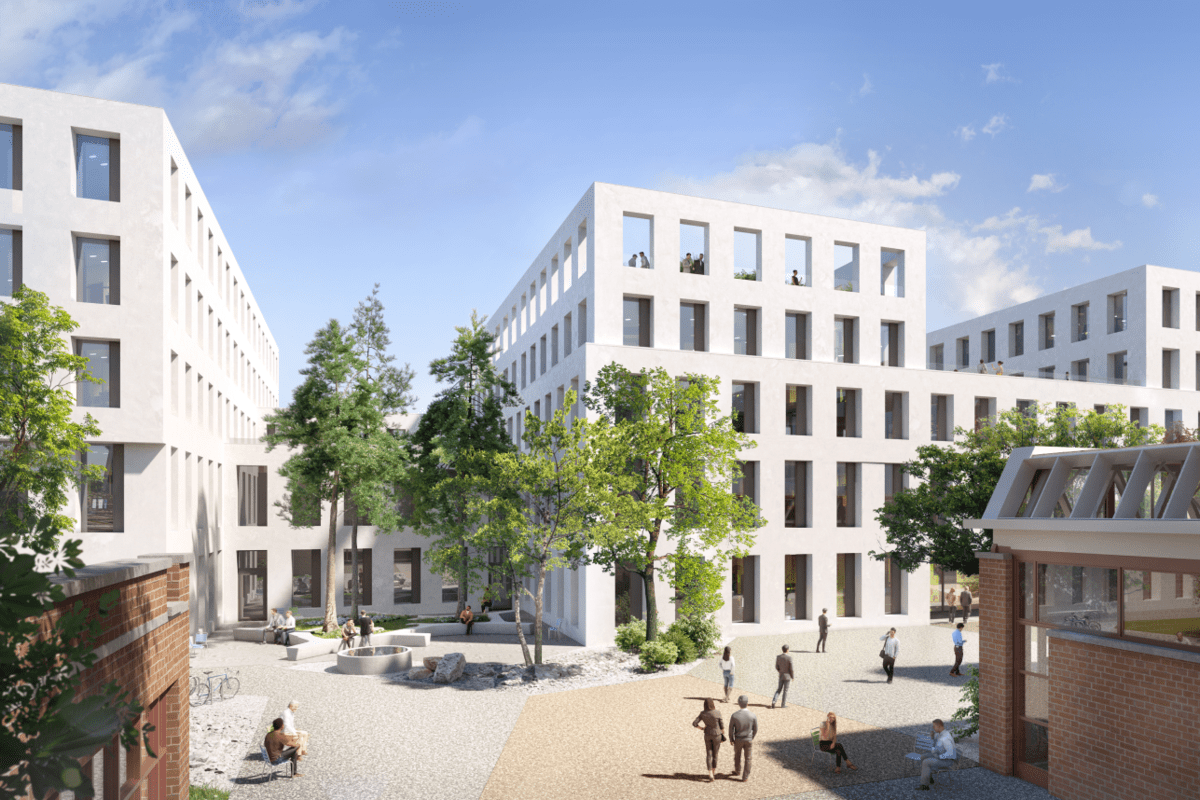

In Basel, the real estate company owns the Tech Park on the Stücki site, which is being expanded: "The demand for ready-to-occupy laboratory and research space has prompted us to significantly expand the Stücki Park by means of two construction phases and to double the area by 27,000 square meters to 60,000 square meters with four new buildings," says CEO René Zahnd. A second cluster for life science exists in Schlieren near Zurich. "There, too, laboratory and research space is being built on our JED site. Both projects in Basel and Schlieren are already almost fully leased today."

Real Estate Asset Management grows

Swiss Prime Site also points to the good development of the Real Estate Asset Management unit, or Swiss Prime Site Solutions: The asset manager raised a total of more than half a billion in capital across all products in the current financial year and assets under management increased to more than CHF 7.3 billion. Around 10% new clients had been acquired. Following the completed acquisition and integration of Akara, strong operational growth is also targeted for the coming years. (ah)