Ina Invest: net profit grows significantly

Ina Invest, a real estate company listed on the SIX Swiss Exchange, increased its portfolio value by 94% in the 2022 financial year. The operating result (Ebit) increased by 12% to CHF 16.1 million, net profit by 59% to CHF 19.1 million.

The company, which was formed as an Implenia spin-off, has thus exceeded the financial targets it set itself for 2022. This was primarily due to higher rental income, which almost quadrupled to CHF 11.3 million, and positive changes in the market value of investment properties of CHF 12.8 million (2021: 16.3 million). The appreciation resulted from operating performance, Ina Invest emphasizes. In addition, there was positive financial income from the sale of an interest rate swap.

Number of buildings doubled to 40

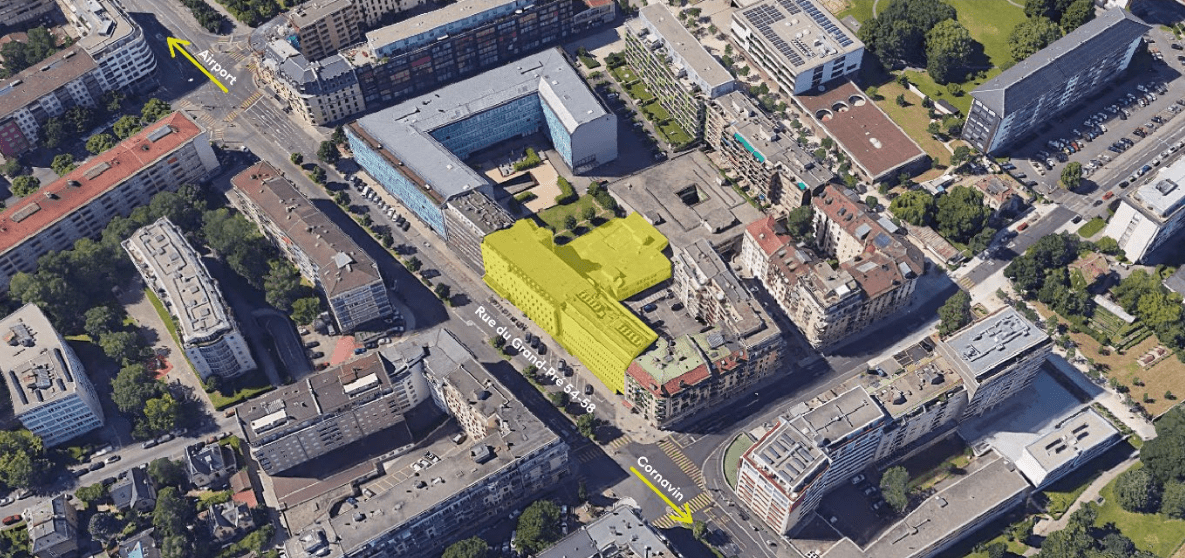

The portfolio has grown significantly. A highlight in January was the closing of the acquisition of the Ceres Group, the owner of the eight-hectare Bredella development site in Pratteln. The development of this site is proceeding according to plan, according to the company. In the meantime, an adjacent property has been sold at a profit. The purchase and integration of the Grand-Pré development property in Geneva also took place in 2022. In total, the Ina Invest portfolio now comprises 40 buildings (end of 2021: 20) in urban locations.

Regarding the development of the portfolio, Ina Invest provides some updates:

- The new "Elefant" building in Lokstadt in Winterthur is 100% leased to an insurance company. The handover for the tenant fit-out took place in December 2022.

- The Holiday Inn Express & Suites hotel in the Baselink area in Allschwil is completed; the opening took place in January 2023.

- The Bredella West design plan was unanimously submitted for consultation by the residents' council, and approval is expected in the 1st quarter of 2024.

- The "Schaffhauserstrasse" project in Zurich has received the building permit.

- The building applications for the Lokstadt halls in Winterthur and the "Birspark" commercial site in Aesch have been submitted.

Ina Invest cites a portfolio size of more than CHF 2 billion and a return on equity (ROE) of more than 6% as its medium-term target. (aw)