CS REF International depreciates by nine percent

The properties in the real estate fund have been revalued because the fund is being converted to a net asset value-based fund.

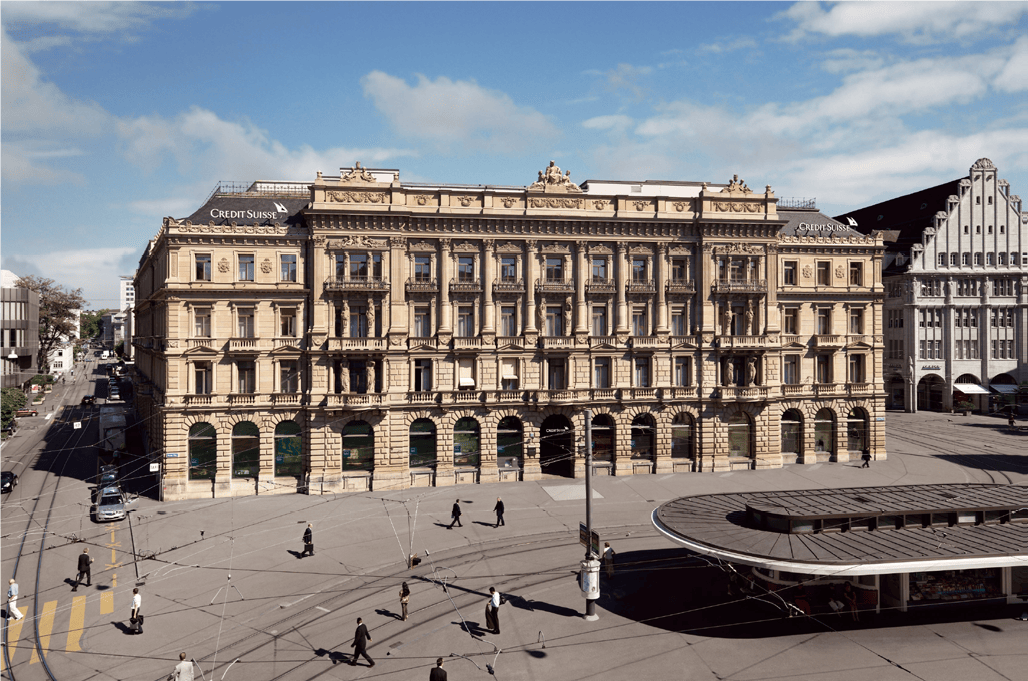

The Credit Suisse Real Estate Fund International (CS REF International) will be converted to a net asset value-based fund as of November 30. According to Credit Suisse Funds, this has been approved by the Swiss Financial Market Supervisory Authority Finma. Off-exchange trading will therefore be discontinued as of this date, with the last day of trading being November 29.

For the changeover, the fund's properties were reviewed as at September 30, 2023. "Valuations have weakened on average by approximately 9% compared to June 30, 2023, in line with the development of the underlying global real estate target markets," Credit Suisse Funds reports. The indicative net asset value (NAV) as at November 30, 2023 is therefore CHF 783.08 compared to CHF 876.76 as at June 30, 2023 and takes into account the valuation adjustment and the current income.

The fund management company had already announced the conversion of CS REF International to a NAV-based fund in October. The background to this is that over-the-counter trading has increasingly failed to meet the expectations of investors and the fund management company in recent quarters. The conditions for the issue and redemption of units remain unchanged, emphasizes Credit Suisse Funds. The fund management company is continuing to examine the possibility of offering investors the option of brokering fund units in the future. (ah)