SPA Real Estate Switzerland: Portfolio grows to 3.9 billion in Q4

In the case of the Swiss Prime AST investment group, strong operating returns were dampened by devaluations in the last quarter.

According to preliminary figures, the "SPA Real Estate Switzerland" investment group closed Q4 2023 with a cumulative investment return of 1.49% (Q4 2022: 4.15%). The return on investment is broken down into a cash flow return of 3.26%, which reflects the operating result, and a value change return of -1.77%.

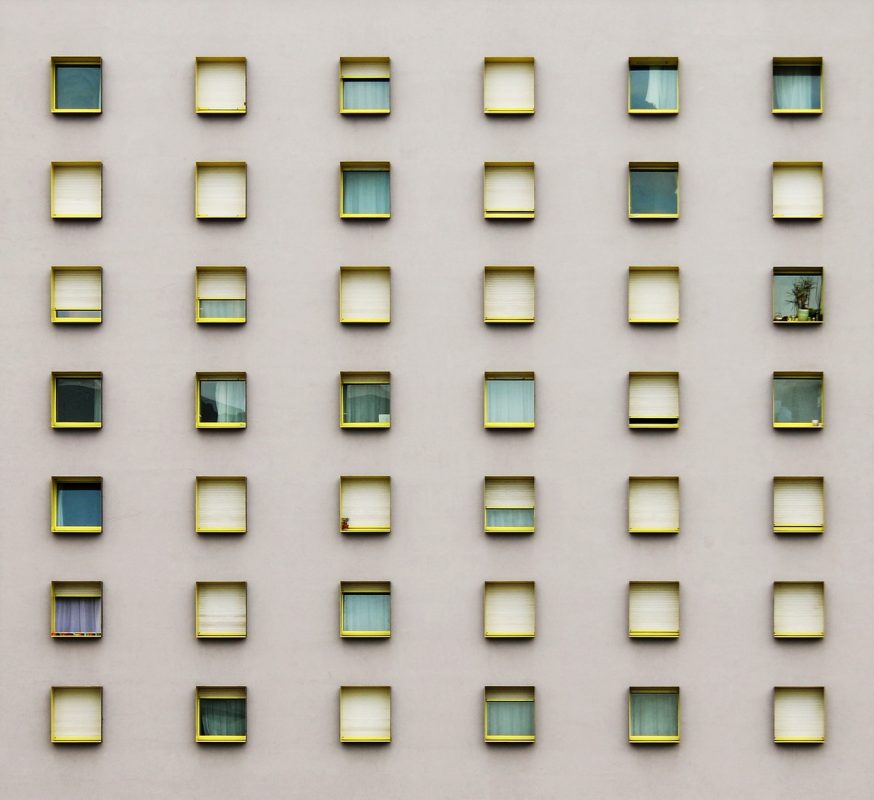

Transactions and project investments increased the market value of the real estate portfolio from CHF 3.67 billion to CHF 3.93 billion. The vacancy rate fell from 2.67% to 1.77% compared to the same quarter of the previous year. The investment group comprises 132 properties, ten of which are development projects.

In the fourth quarter, the property at Place Cornavin 10 in Geneva with hotel and retail use was sold to an international investor. The investment group also disposed of Bronschhoferstrasse 2 in Wil. This is a mixed-use property built in 1969 and was sold to a Swiss real estate owner on December 1 after partial repositioning in fully let condition.

Neugasse 31/31a/31b/33 in Bazenheid in eastern Switzerland was added to the portfolio in December The four apartment buildings, built in 2010, have a total of 56 apartments and 66 parking spaces. (aw)