PSP Swiss Property confirms forecast for 2024

Profit increases as a result of revaluations. Sales of smaller properties generated proceeds well above book value.

The balance sheet value of PSP Swiss Property's real estate portfolio increased from CHF 9.6 billion to CHF 9.7 billion in the first half of the year. At 4.0%, the vacancy rate was higher than at the end of 2023 (3.6%), but slightly lower than in the first quarter (4.1%). The portfolio comprised 157 investment properties. There were also two sites and eight development properties.

Sales significantly above book value

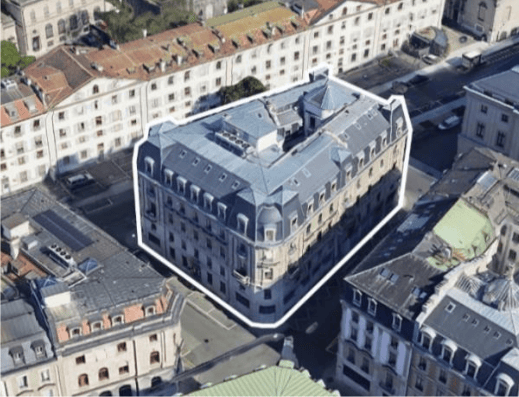

The most important single transaction of the half-year was the purchase of the commercial property in Geneva's "Quartier des Banques" for CHF 58.0 million (IB reported). On the other hand, six smaller investment properties in secondary locations were sold for a total of CHF 82.5 million. The sales proceeds exceeded their last valuation by CHF 11.3 million or 16.1%. As CEO and CFO Giacomo Balzarini explained at the annual results press conference, the buyers were very diverse - including private investors and institutional investors. However, the bidding market was by no means low, with two to three bidders per property.

Discount rate unchanged on average

Overall, revaluations of the properties resulted in an appreciation of CHF 44.7 million. However, the majority of this (CHF 31.2 million) had already been incurred in the 1st quarter. The weighted average discount rate for the entire portfolio remained unchanged at 3.85% despite property-specific fluctuations.

Higher financing costs

The operating result, i.e. profit excluding gains/losses on real estate investments, fell by CHF 24.5% to CHF 113.6 million. By way of explanation, PSP refers to the reversal of deferred taxes of CHF 30.6 million, which had characterized the comparative figures for the previous year as a special effect. However, real estate income increased by CHF 7.9% to CHF 176.2 million in the first half of 2024. Lower income from the sale of development projects and condominiums by CHF 9.7 million, lower own work capitalized by CHF 1.7 million, a CHF 0.4 million increase in operating expenses and a CHF 8.5 million increase in net financing costs had a negative effect. Financing costs remained relatively low at a cost of debt of 0.95% over the last four quarters (end of 2023: 0.72%).

Net profit of 156 million

Net profit rose from CHF 76.9 million to CHF 156.3 million due to the aforementioned revaluation. In the first half of 2023, a devaluation of CHF 90.7 million had still been recorded. With an equity ratio of 53.4%, the equity base remains virtually unchanged and solid.

Forecast confirmed

For the year as a whole, the company confirms the forecast raised in the first quarter of EBITDA excluding gains/losses on real estate investments of CHF 300 million (2023: CHF 297.7 million). The vacancy rate is still expected to be below 4% at the end of 2024.

Sales in Aarau, Berne, Fribourg, Lucerne and Olten

These were the properties sold:

- Aarau, Bahnhofstrasse 18

- Berne, Haslerstrasse 30/Effingerstrasse 47

- Fribourg, Rue de la Banque 4/Route des Alpes

- Lucerne, Maihofstrasse 1

- Olten, Baslerstrasse 44 (aw)