Mobifonds Swiss Property increases distribution

The growth in income more than compensated for higher costs. However, the fund management company is not satisfied with the off-exchange performance.

Mobifonds Swiss Property recorded growth in rental income from CHF 36.6 million to CHF 39.9 million in the past financial year. This was primarily due to the Alchenflüh property, which was completed in September 2023, the higher reference interest rate and a further reduction in the rent default rate to 2.0%. According to the information provided, the growth in income more than compensated for the further increase in mortgage costs and higher property and maintenance expenses. Net income increased from CHF 24.1 million to CHF 25.5 million, with the value per unit rising from CHF 3.57 to CHF 3.78. The distribution to investors is set to increase by CHF 0.10 to CHF 3.50 per unit.

As at the reporting date, the fund held 22 properties with a market value of around CHF 1.1 billion. The portfolio was revalued by 1.1%. "The significant increase in expected rental income compensated for a slight increase in the average discount rate," writes Mobiliar. As a result, the net asset value (NAV) per unit rose to CHF 135.65, which led to a return on investment of 3.9%, an increase of 2.4%. Including the valuation result of CHF +8.7 million (previous year: CHF -11.9 million), total income rose from around CHF 13.3 million to CHF 34.2 million.

However, the performance of the over-the-counter price was negative at -3.5%. According to Mobiliar, this was primarily due to the persistently insufficient trading liquidity of the securities. The fund management company is examining "various strategic measures to improve the situation".

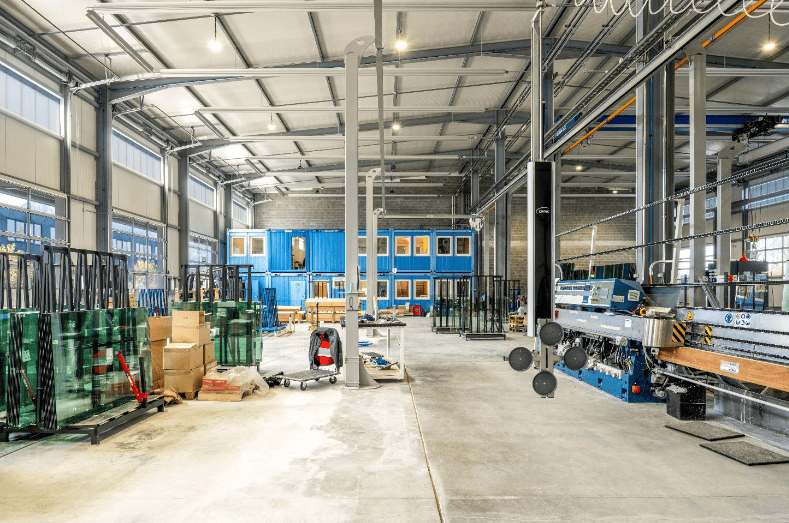

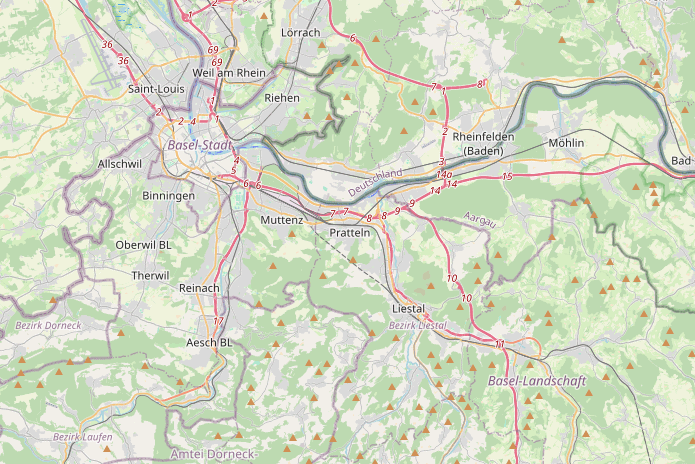

Basel: Office building to be replaced by residential building

The only real estate transaction of the financial year was the acquisition of the office property at Nauenstrasse 49 in Basel in December. A new replacement building with a large proportion of residential use is to be built on this property and on a neighboring plot for which there is an option to purchase. In addition to around 2,400 square meters of commercial space on the lower floors, around 70 apartments are to be built on the upper floors. According to an earlier announcement, the planned investment volume amounts to CHF 63 million. (aw)