Swiss Prime Site increases rental income despite sales

SPS made virtually no acquisitions last year, but adjusted its portfolio to remove properties with a market value of CHF 343 million. Rental income nevertheless grew considerably.

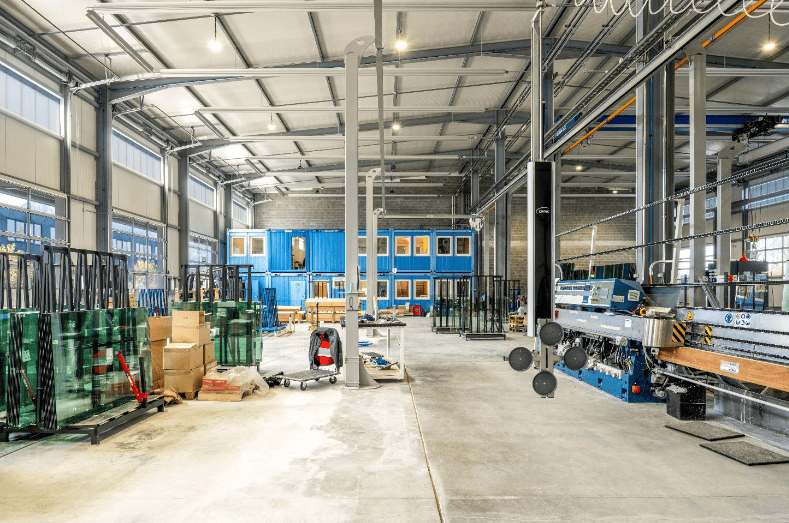

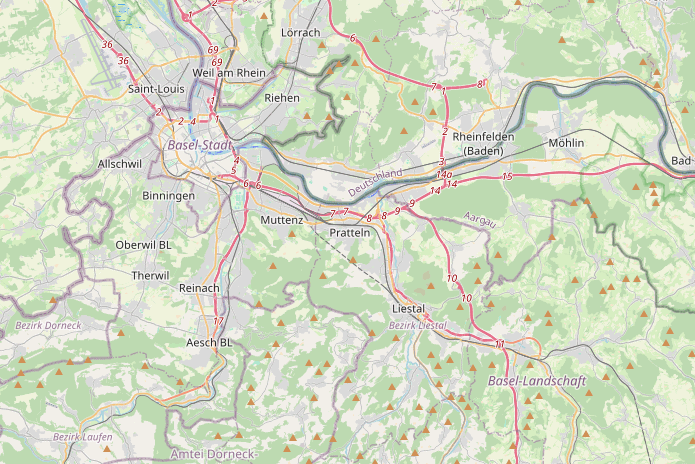

Swiss Prime Site presented its figures for the 2024 financial year today and reported rental growth of CHF 5.7% to a record CHF 464 million. Including rental income lost due to sales, the increase was even around 9%, CEO René Zahnd said at the analyst conference. Income from newly let developments made a significant contribution to this, in particular the newly let office building on Müllerstrasse and the "Fifty-One" office building acquired in 2023, the new Alto office building in Geneva-Lancy and the Stücki Campus in Basel with four extension buildings. Growth on a like-for-like basis amounted to 3.3%. The vacancy rate at the end of 2024 was 3.8%, 0.2 percentage points below the previous year.

The growth in real estate assets to CHF 26.4 billion was entirely attributable to the Asset Management division, which increased its assets under management by CHF 4.9 billion through the acquisition of Fundamenta. By contrast, the company's own real estate portfolio remained constant at CHF 13.1 billion, although SPS held back almost completely as a buyer during the year, selling properties with a market value of CHF 345 million and only buying additional properties as part of a single consolidation. In particular, positive revaluations of CHF 113.7 million (previous year: CHF -250.5 million) had a positive impact. The average discount rate applied remained unchanged, meaning that the change was purely due to operational improvements, according to SPS. According to the information provided, the sale of a total of 23 properties in the second half of the year generated an average profit of 3% above the last appraised value.

FFO increases by 4.2%

Consolidated operating profit before depreciation and amortization (EBITDA) increased from CHF 389.7 million to CHF 415.1 million. In particular, the sale of Wincasa in the previous year is not included in the comparative figure. The current operating profit includes a loss of CHF 6.9 million (previous year: +1.5%) from the retail business of the Jelmoli department store, which is about to close. SPS explains the loss primarily with discount campaigns.

The real estate company's operating results exceeded the forecast. The cash-effective result (FFO I) increased by 4.2% to CHF 4.22 per share. An increase to up to CHF 4.20 had been forecast. The proposed dividend increases to CHF 3.45 per share.

Another look at buying opportunities

SPS is optimistic about the outlook for 2025: Although the result for the proprietary portfolio will be impacted by the loss of the Jelmoli rent of around CHF 20 million net on an EBITDA basis, rent increases and newly let properties will "significantly cushion" this effect. In addition, Swiss Prime Site sees more opportunities for acquisitions again due to the brighter market situation. Opportunities are increasingly being examined. Nevertheless, SPS has again set itself the goal of "streamlining the portfolio" for the current year. In the Asset Management segment, AuM is set to rise to CHF 14 billion.

Slightly lower FFO expectation

However, SPS is lowering its forecast for FFO I per share to CHF 4.10 to 4.15, which it says is due to the closure of Jelmoli. However, especially after the reopening of the department store at the end of 2027, there is "significant growth potential of over 10%" for FFO. (aw)