Intershop closes transaction-rich year

In 2024, the company increased its real estate income and acquired or sold a total of 13 properties. Intershop also sees opportunities for the current financial year.

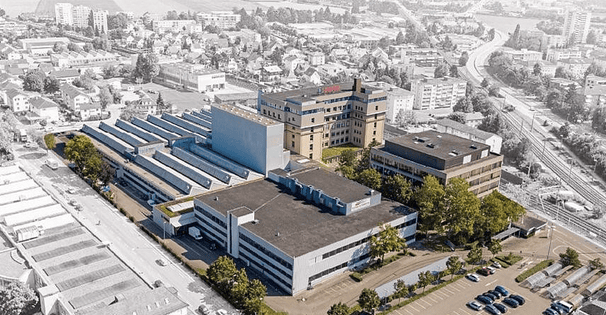

At Intershop, rent increases and lettings led to an increase in property income of CHF 2.2 % to CHF 82.2 million in the 2024 financial year. The year was characterized by numerous transactions: Six properties were sold for CHF 77.1 million, realizing a pre-tax profit of CHF 23.2 million. This was offset by seven acquisitions with a total volume of CHF 152.5 million. At CHF 99.1 million, the positive balance from transactions was one of the main reasons why the value of the real estate portfolio rose by CHF 15.7 % to around CHF 1.6 billion. However, investments (57.6 million) and a net appreciation of 3.9 % (59.7 million) also contributed to this. According to Intershop, the increase in value was mainly due to the revaluation of two properties. The significantly better valuation result (previous year: 12.0 million) led to an increase in net profit from CHF 82.5 million to CHF 117.5 million. While the company's return on equity improved from 9.6 to 13.4 %, the dividend remains unchanged at CHF 5.50 per share.

Average interest rate slightly lower

As a result of the transactions and investments, interest-bearing financial liabilities increased by % 36.9 to CHF 522.0 million compared to the previous year. The equity ratio fell year-on-year from 62.0% to 57.5%. However, at 1.40%, the average interest rate at the end of the year was lower than a year earlier (1.67 %). Meanwhile, the average fixed interest rate fell from 4.3 to 3.1 years.

Intershop wants to "exploit opportunities" in 2025

Intershop expects the transaction market to pick up in the current financial year and has announced that it will actively participate in it. "Opportunities for both acquisitions of properties with development potential and sales of fully developed properties will be consistently exploited". Based on the purchases already made, net property income is expected to increase by "at least 8 %" in the 2025 financial year. (aw)